The Ministry of Culture, Sports and Tourism of Korea (MCST) and the Korean Arts Management Services (KAMS) have been publishing a report on the previous year’s Korean art market since 2008.

2021 was a special year for Korea, as its art market achieved the most explosive growth since 2007. To predict and analyze the size of the Korean art market in advance and to examine the prospects of this year’s art market, the two organizations collaborated to hold the Korean Art Market Settlement Conference on December 30, 2021. The collected information and data from the conference were released on KAMS’s website in January.

We have summarized the information presented in the report, mainly focusing on the Korean art market size and the changes in the collectors’ tastes compared to 2020. Detailed information on the art auction results or the analysis of overseas art markets that were also discussed in the conference can be found in KAMS’s website.

Cover page of "Korean Art Market Settlement Conference." Korean Arts Management Services. © Ministry of Culture, Sports and Tourism & Korea Arts Management Service.

KAMS predicted the size of the Korean art market in 2021 at 922.3 billion KRW (approximately $770.5 million) as of December 20. This is the highest total ever in the Korean art market history. This amounted to a 180.2% increase from 2020’s 329.1 billion KRW ($274.8 million) and was far more than double the 381.2 billion KRW ($319 million) in 2019, before the outbreak of COVID-19.

The size is comparable to the size of the Spain’s art market in 2020. According to the Art Basel and UBS’s Global Art Market Report, global art sales in 2020 reached an estimated $50.1 million. Spain was listed as the 7th-largest art market, accounting for 1% of 2020’s global art sales, surpassed by the United States (42%), Greater China (20%), the United Kingdom (20%), France (6%), and Switzerland (2%) and Germany (2%).

Of the art market’s three-section—dealers(galleries), auction houses, and art fairs—the gallery sales increased by 164.3% or to about 440 billion KRW ($367.4 million). The auction sales were estimated to be around 328 billion KRW ($274 million) to 340 billion KRW ($284 million), an increase of 183.2% year over year. The art fair section showed the highest growth rate, which was measured to be about 154.3 billion KRW ($129 million), an increase of 229.7% year over year.

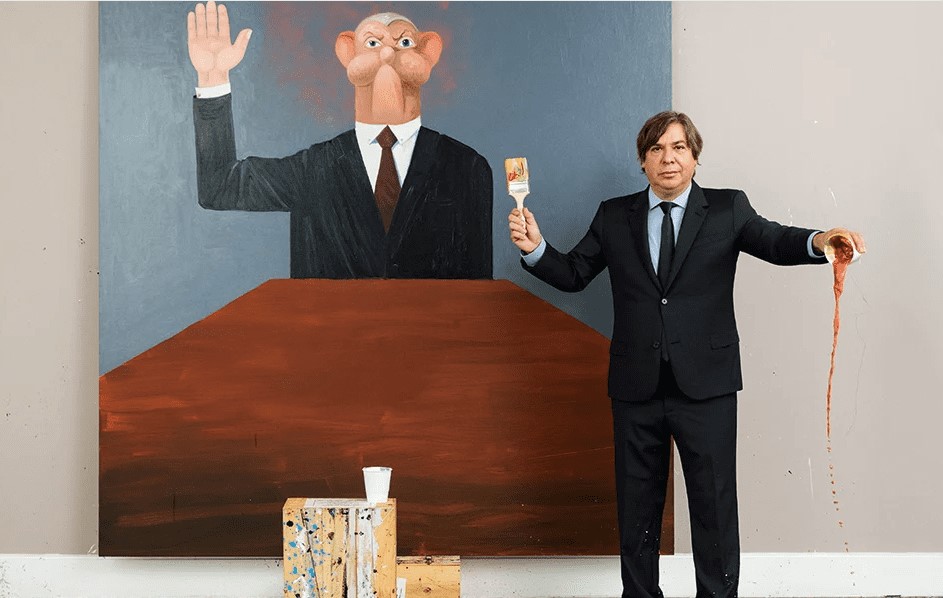

Photo by Алекс Арцибашев on Unsplash.

The conference compared the most common buzzwords that appeared in art market-related articles in 2021 to 2020.

Words such as “overheating,” “polarization,” and “bubble” frequently appeared in 2021, while many words denoting decline such as, “crisis,” “fall,” and “recession,” appeared in 2020.

Words related to various news was announced in 2021 also emerged as keywords in the articles,

including the upcoming September’s Frieze Seoul; the reopening of the Leeum Museum of Art; the Lee Kun-hee Collection; numerous names of renowned international galleries that opened outposts or expanded their spaces in Seoul, such as Pace and König; and BTS’s RM.

In terms of artists and artworks, in 2020, Dansaekhwa and related artists, such as Lee Ufan, Kim Whanki, and Yun Hyong-keun, as well as international artists, including KAWS, Yayoi Kusama, and Yoshitomo Nara, represented the most frequently appeared words.

In 2021, new names of more lesser-known and younger Korean artists, such as Woo KukWon, and Kim Sun Woo, and the Korean avant-garde artists, such as Lee Kun-Yong and Kim Kulim, emerged as keywords.

The MZ generation turned out to be one of the most influential factors of the rapid market growth. Jo Sangin of Seoul Economic Daily mentioned that the younger generations, who are distinctive in terms of communication, have changed the collecting culture in Korea.

In the case of Korea, keeping track of artworks is especially difficult because, once an artwork goes into a personal collection, it is customary for the galleries to keep it private, which makes it difficult to identify the trends in collecting. But the younger collectors tend to prefer comprehensive self-expression, making it easier for market watchers to understand collector propensity.

Photo by Precondo CA on Unsplash.

The younger generation’s tendency for art collecting is more centered around pop art and paintings by peer artists whose works are considered trendy, such as Seungcheol Ok, Moon Hyung-Tae, Woo KukWon, Kim Sun Woo, and other emerging international artists.

Also, they have a strong tendency to approach artworks for investment purposes.

These generations have come of age during a time of technological change, economic disruption, and globalization, which has given them a different set of experiences than their parents, leading them to embrace various investment technologies more than any previous generation.

It was understood that the significant demand for high-priced prints and editions of over 10 million KRW (roughly $8,000) by international blue-chip artists was largely due to investment reasons. Demand for the artwork of internationally renowned Korean artists, such as Park Seo-Bo and Kim Tschang-Yeul was also high.

The artworks by the above-mentioned artists surged in last year’s, market but this was only the case for a few artists. Other established artists in their forties and fifties were comparably shunned, as well as the work of some modern masters, such as Park Soo Keun and Lee Jung Seob.

Despite the strong investment tendency, it was understood that this trend will bring positive effects in expanding the collector base, since it will lead more people to gain interest in the art world.

With a number of galleries opening outposts in Seoul due to Frieze Seoul being scheduled to open this September, market watchers expected the Korean art market to grow further this year.

More information on the conference can be found on KAMS’s website.