The most significant event in the domestic art market, Frieze Seoul, concluded in early September. Following this high-profile event, the initial excitement is gradually stabilizing, as the domestic art market seems to either continue riding the wave of interest or take a moment to pause and reflect.

Frieze 2024 ©Frieze & Lets Studio. Photo: Lets Studio.

Frieze 2024 ©Frieze & Lets Studio. Photo: Lets Studio.As we move into October, with only three months left in 2024, it is crucial to examine the anticipated trends in the art market for the remainder of the year.

| Auction Trends

The September auction results from Seoul Auction and K Auction indicate a relatively strong performance compared to average bidding outcomes. Seoul Auction conducted its sale in early September, capitalizing on the Frieze effect. The auction concluded with a sell-through rate of 67.6% and a total sales volume of 6.28 billion KRW, surpassing August's results.

“Contemporary Art Sale” Preview at Seoul Auction. ©Seoul Auction.

“Contemporary Art Sale” Preview at Seoul Auction. ©Seoul Auction.K Auction also showed improvement, reporting a total sales volume of 3.7 billion KRW in September, up by 800 million KRW from August's total of 2.9 billion KRW. However, the sell-through rate slightly decreased to 60% from 64.7%.

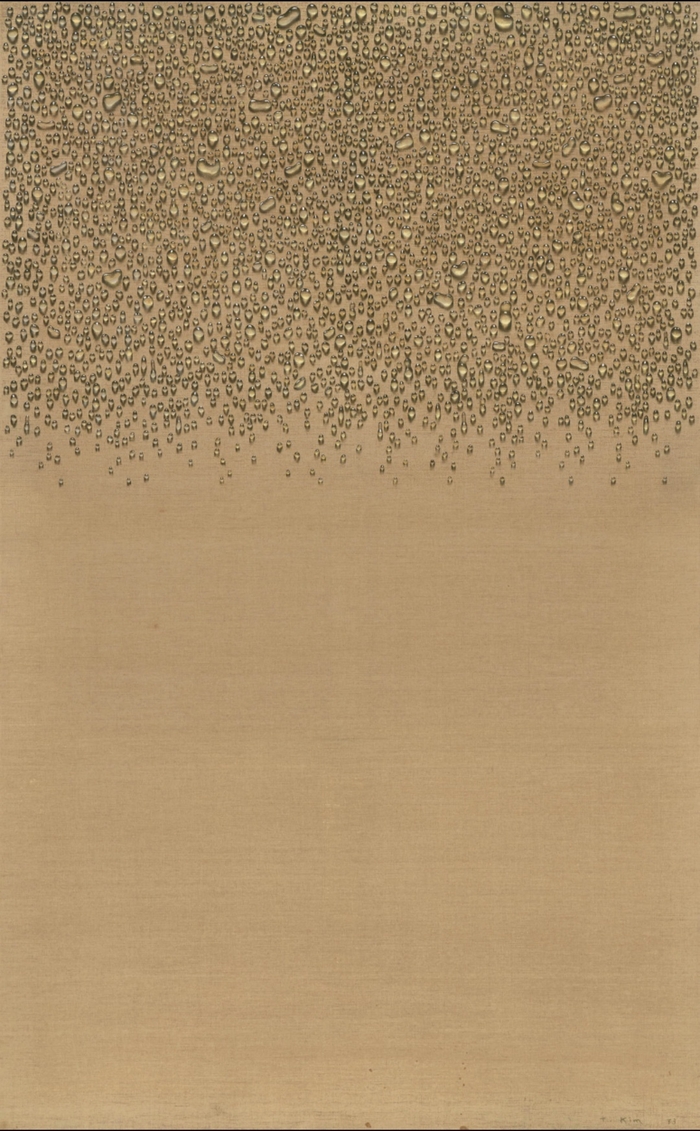

Kim Tschang-Yeul, Water drops, 1973: Initially Offered at 1 Billion KRW and Subsequently Withdrawn from the September Auction ©K Auction

Both auction houses have shown a predominance of mid- to low-priced artworks in their sales, with high-value pieces often going unsold or being withdrawn from auction. This trend is likely to continue for the foreseeable future. As the art market has softened, the number of collectors seeking to consign their works has decreased. Concerns over the possibility of artworks selling for lower prices than in the past lead many collectors to hesitate in putting their pieces up for auction.

Overview of Seoul Auction ©Seoul Auction

Overview of Seoul Auction ©Seoul AuctionFrom the buyers' perspective, economic challenges make it difficult to commit to purchasing high-value artworks. As a result, the number of quality pieces available at auction is diminishing, leading to fewer successful sales and a contracting auction market. Conversely, for serious buyers, this period presents an opportunity to acquire artworks at more affordable prices.

| Galleries Trends

During the Frieze period, numerous galleries showcased their marquee artists, creating a vibrant exhibition landscape. Many galleries aimed to attract attention by presenting renowned international artists, whose works are rarely seen in domestic exhibitions.

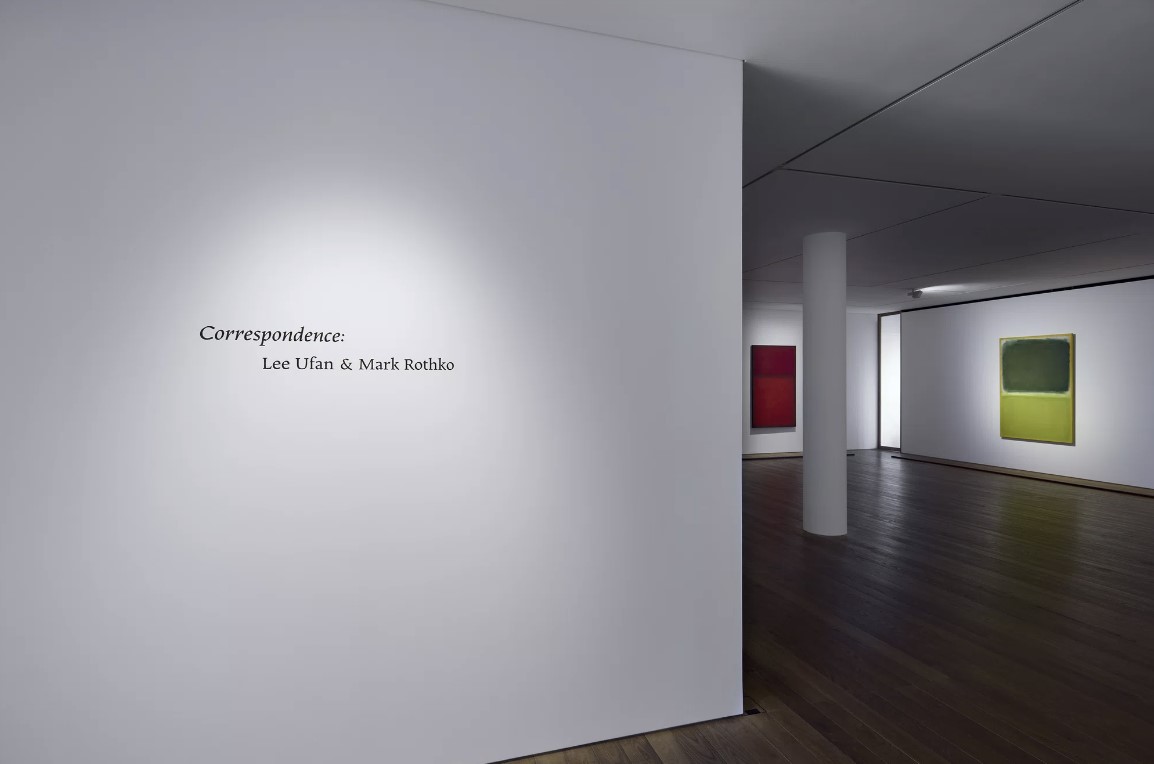

“Correspondence: Lee Ufan and Mark Rothko” Exhibition view

at PACE Gallery ©PACE Gallery

“Correspondence: Lee Ufan and Mark Rothko” Exhibition view

at PACE Gallery ©PACE GalleryA notable example is the duo exhibition of Lee Ufan and Mark Rothko at Pace Gallery, which generated significant buzz, with lines extending into the alleyways of Hannam-dong. Given the effort invested in these exhibitions, many continued through early October. However, this report will focus on new exhibitions that began in late September, moving beyond the influence of Frieze Seoul.

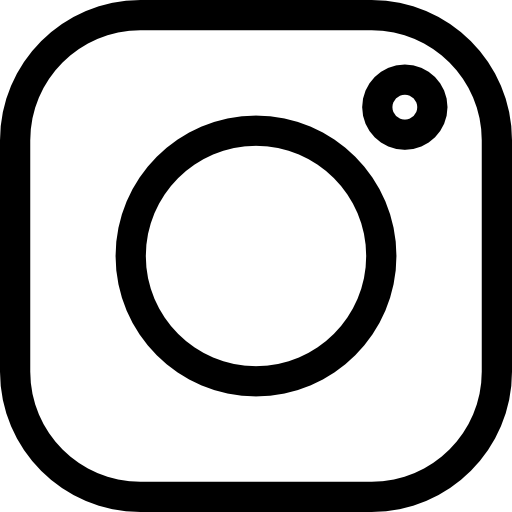

Meekyoung Shin ©Maison Korea

Meekyoung Shin ©Maison KoreaAmong the numerous exhibitions currently on display, Meekyoung Shin's solo show at WWNN, running from September 28 to October 27, stands out. Well-known for her soap sculptures, Shin explores themes of creation, decay, and regeneration in her exhibition titled “Chronicles of Collapse”. Given that the transformative nature of soap plays a central role in her work, collectors seeking permanence may find it challenging to invest in her pieces.

‘Chronicles of Collapse’ Exhibition view at WWNN ©WWNN

Consequently, Shin is not frequently encountered in the secondary market, particularly at auctions. However, considering the enticing aromas, forms, colors, and meanings inherent in her works—provided they are not utilized—there remains a compelling desire to own them.

Meekyoung Shin, Ghost

Series, 2007-2013 ©MMCA

Meekyoung Shin, Ghost

Series, 2007-2013 ©MMCAFor instance, the intricately crafted ‘Ghost’ series is priced between 13 million and 31 million KRW, while the smaller ‘Painting’ series, resembling wall-mounted flat artworks, typically trades around 8 million KRW. These relatively accessible prices offer collectors an opportunity to acquire remarkable pieces.

| Art Fairs Trends

In late October, the newly launched Define Seoul will take place in Seongsu-dong, a part of Art Busan. As indicated by its name, Define Seoul 2024 will merge design and fine art, showcasing design pieces, vintage furniture, crafts, and contemporary artworks.

Define Seoul 2023 Kukje Gallery ©Kukje Gallery

Define Seoul 2023 Kukje Gallery ©Kukje GalleryThis year, over 40 domestic and international galleries and design studios will participate, marking a 1.5 times increase in scale compared to last year. The fair will be held in Hall D of S Factory, with an audience-engaging satellite exhibition taking place at the Y173. This initiative aims to elevate Define Seoul beyond a traditional art fair, fostering a dynamic artistic environment that encourages interaction and appreciation.

Define Seoul 2024 Poster ©Define: Seoul

Define Seoul 2024 Poster ©Define: SeoulDefine Seoul 2024 will feature prominent international design studios and galleries, including Atelier Oï, Giopato & Coombes, Galerie Zink from Germany, and YOOMOOTA from Thailand. Additionally, several domestic exhibitors, such as Wooson Gallery, Gallery JJ, Mimihwa Collection from Busan, YG PLUS's art label PEECES, and studio HJRK, aim to expand the realms of art through crafts, design furniture, and collectible art.

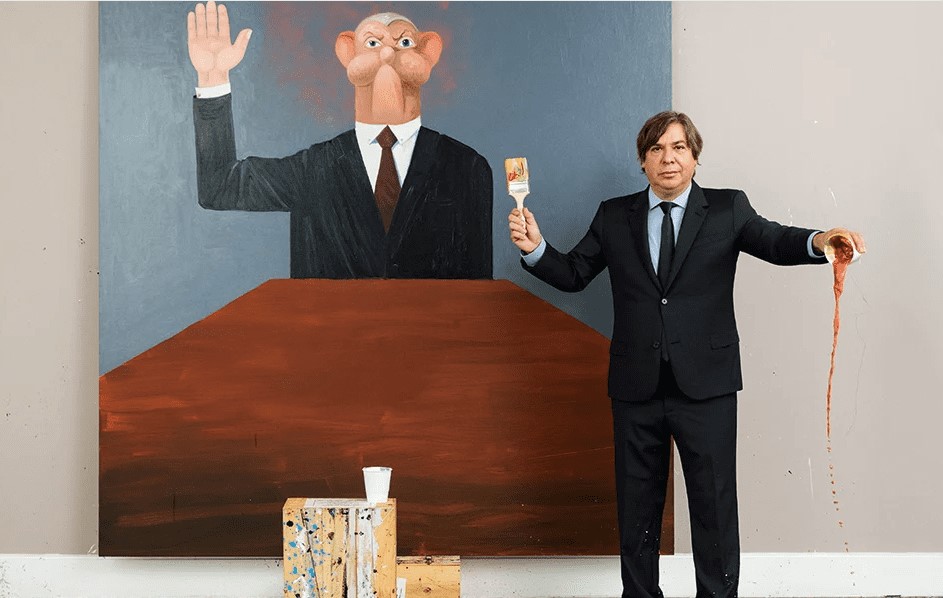

Atelier Oï, Serpentine Table GM, ©Louis

Vuitton

Atelier Oï, Serpentine Table GM, ©Louis

VuittonAtelier Oï, a Swiss design studio, has collaborated with prestigious brands like Louis Vuitton, Nespresso, and Rolex, showcasing performances that bridge design and art. One of their notable works includes furniture created in partnership with Louis Vuitton, with prices for chairs, lighting, and stools set at 14.9 million KRW, 11.6 million KRW, and 6.9 million KRW, respectively.

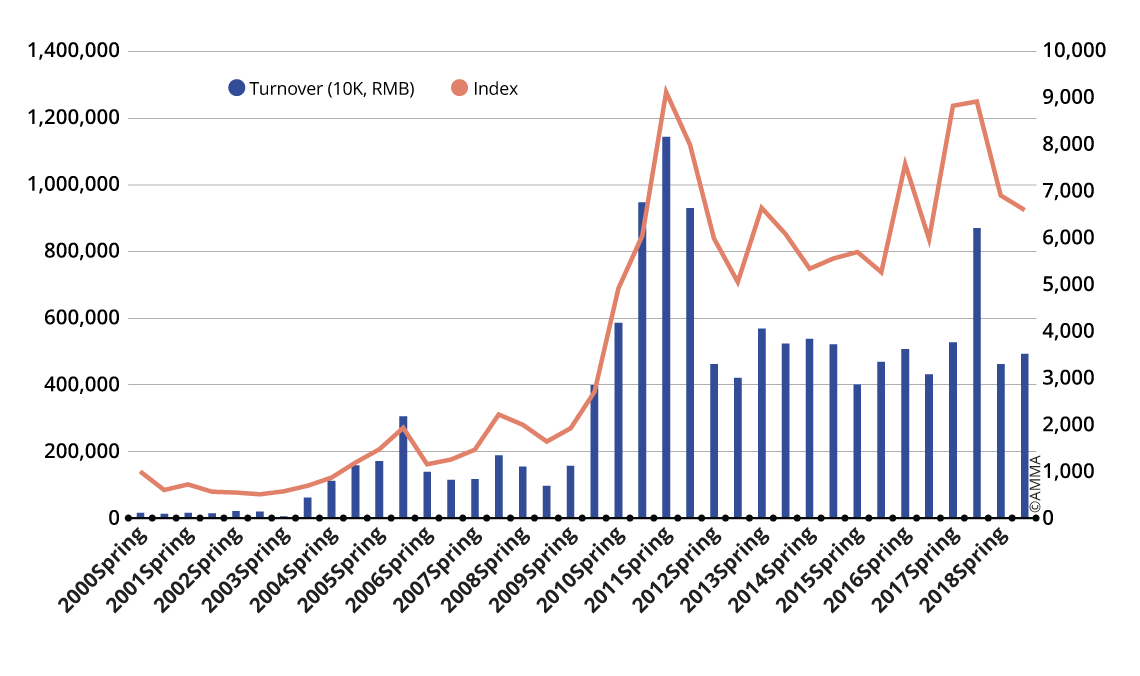

In the third quarter of this year,

the art market saw several high-value transactions that attracted attention. A

notable example is Yayoi Kusama's yellow pumpkin, which sold for approximately

13.4 billion KRW at Seoul Auction in September.

However, compared to the art boom

of 2022, the volume of high-value sales has significantly declined, and the

overall number of artworks traded has also decreased. Despite the presence of

major events like Frieze, their impact appears to be temporary, making it

challenging to reverse the ongoing two-year stagnation in the market. Given

these trends, it is anticipated that conditions in the remaining quarter will

likely remain stable and unchanged.