Together Art, a leader in the fractional art investment market, has announced the public offering of its 6th investment contract security, featuring Nicolas Party's Landscape as the underlying asset. This marks the sixth investment contract issued by Together Art this year, setting a record for the most offerings in the industry.

Landscape

by Nicolas Party / Together Art Official Website

Landscape

by Nicolas Party / Together Art Official Website

The

public subscription for the 6th product will be open until December 18. The

underlying asset is Landscape, a 2014 work by Swiss contemporary artist Nicolas

Party. A total of 229,500 shares are being offered at 10,000 KRW per share,

with a total subscription amount of approximately 2.295 billion KRW. The

artwork was acquired in October through a pre-purchase deal with the global

auction house Christie's for approximately 2.1 billion KRW.

With

this offering, Together Art will have completed six public offerings of

investment contract securities in 2024 alone, the most in Korea's fractional

art investment market. According to the Financial Supervisory Service's

electronic disclosure system, this year’s issuance records show Together Art

leading with six offerings, followed by Yeolmae Company with three and Seoul

Auction Blue with one.

Earlier

this year, Together Art introduced investment products featuring works by

renowned artists:

1st:

Yayoi Kusama's Pumpkin

2nd:

George Condo's The Horizon of Insanity

3rd:

George Condo's Untitled

4th:

Yoshitomo Nara's The Pond Girl

5th:

Lee Ufan's With the Wind

Together

Art has also demonstrated strong performance in generating returns. Two of its

investment contracts have already been successfully liquidated, delivering

notable returns to investors. In August, George Condo's Untitled

(3rd product) was sold, achieving a nominal return of 9.56%. In October,

Yoshitomo Nara's The Pond Girl (4th product) was liquidated

within just three months, providing a return of 8.24%.

Leveraging

the infrastructure of its parent company, K Auction, Together Art focuses on

building an efficient issuance-to-sale cycle, enabling the seamless circulation

of investment funds. This strategy has solidified its position in the art

investment market. Industry experts have praised Together Art’s ability to

select premium underlying assets and its emphasis on investor protection,

fostering strong market confidence.

An

industry insider remarked, “Together Art has garnered trust in the fractional

investment market by introducing high-quality works from globally acclaimed

artists such as Yayoi Kusama and George Condo. Its transparent liquidation

process and stable returns have attracted positive responses from investors.”

Looking

ahead, Together Art plans to expand its offerings by reflecting global art

market trends, further establishing its leadership in the STO (Security Token

Offering) sector.

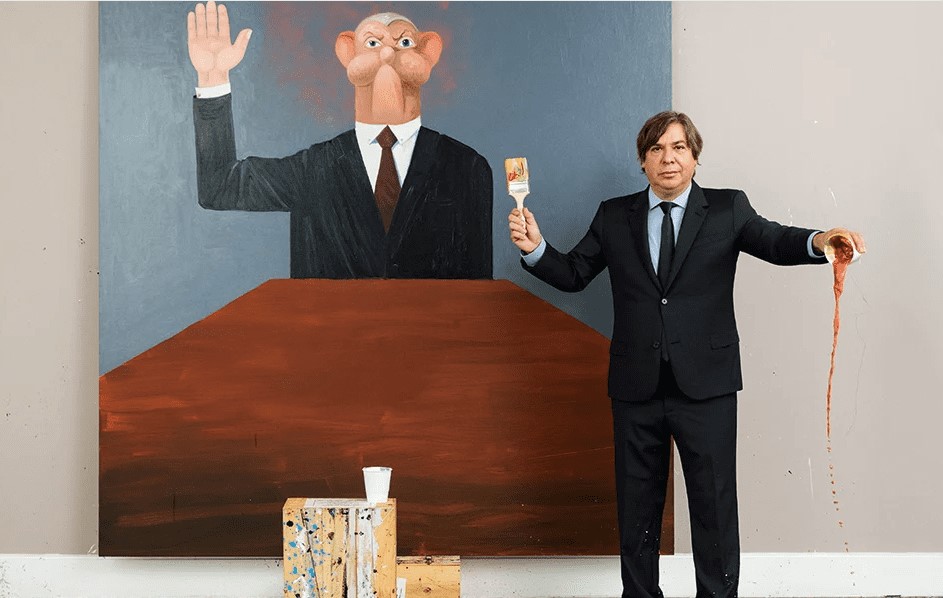

Jay Jongho Kim graduated from the Department of Art Theory at Hongik University and earned his master's degree in Art Planning from the same university. From 1996 to 2006, he worked as a curator at Gallery Seomi, planning director at CAIS Gallery, head of the curatorial research team at Art Center Nabi, director at Gallery Hyundai, and curator at Gana New York. From 2008 to 2017, he served as the executive director of Doosan Gallery Seoul & New York and Doosan Residency New York, introducing Korean contemporary artists to the local scene in New York. After returning to Korea in 2017, he worked as an art consultant, conducting art education, collection consulting, and various art projects. In 2021, he founded A Project Company and is currently running the platforms K-ARTNOW.COM and K-ARTIST.COM, which aim to promote Korean contemporary art on the global stage.