The most-searched term in the Korean art world in 2022 was “Frieze Seoul.” The inaugural fair received not only explosive attention from the domestic art world but also aroused international interest in the Korean art market, bringing many global artists to Korea.

Those who visited Korea for Frieze Seoul commented that the Korean art scene showed a strong ecosystem. They were also surprised by the widespread enthusiasm and interest of Korean visitors to the fair. However, many also mentioned the difficulty of finding information on the Korean contemporary art scene and the language barrier.

Paradise Cultural Foundation and Seoul National University, with support from the Korea Arts Management Service (KAMS), published Korea Art Market 2022, Korea’s first English report on the art market, on December 21, 2022, to provide various information on the Korean art market in English.

Korea Art Market 2022 was published to introduce the diverse trends and issues within the South Korean art market to a global audience. The report examines and forecasts trends in the Korean contemporary art market, focusing on various keywords such as art fairs, auctions, collector trends, artist theories, and museum exhibition trends through empirical analysis of various data and figures by art experts.

The report analyzed the trends of the Korean art market in 2022 with eight key findings.

Kiaf PLUS 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

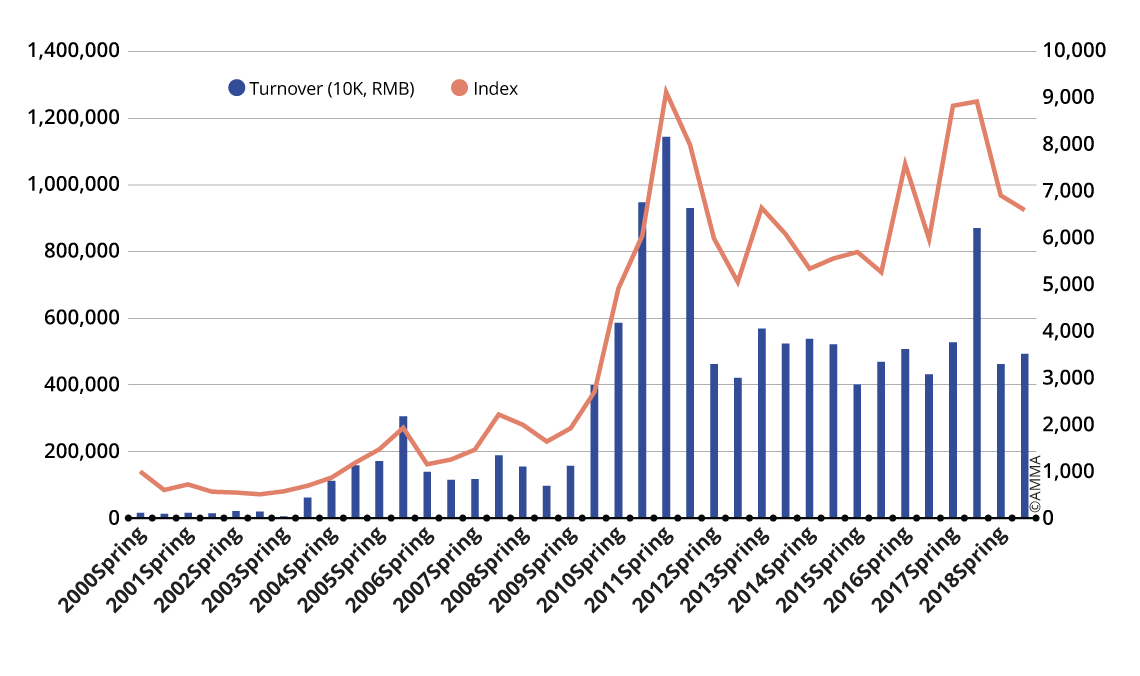

Kiaf PLUS 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.The report mentioned the rapid growth of the Korean art market, which was valued at around 400 billion KRW (Korean won) from 2018 to 2020 but nearly doubled to about 922.3 billion won in 2021. This was nearly double the market size of 2019 before the COVID-19 pandemic. It is estimated that the market size will have exceeded 1 trillion KRW in 2022. While this growth is expected to continue next year, the auction market is expected to face some adjustments.

The art auction market peaked in the third quarter of 2021 and entered a correction phase. But some experts see this as a good opportunity for the market to control excessive competition between auction houses and to clear the bubble.

The growth in the size of the Korean art market was attributed to the influx of millennials and Generation Z in Korea, people ranging from their 20s to their 40s. This influx comprises not only young collectors but also young artists. However, according to the report, the group with the greatest purchasing power in the Korean art market was millennials born in and after the 1980s and Generation X, born after the mid-1960s. It was found that 85% of the respondents to the survey on Korean art buyers conducted by the KAMS were from these two generations. Unlike baby boomers and Generation X, millennial collectors prefer foreign artists and artists based outside Korea.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.The sharp increase in the art fair market due to the influx of art buyers and the holding of Frieze Seoul was also cited as a key finding of the 2022 Korean art market. The Korean art market is mainly dominated by sales from galleries. But the share of the art fairs increased last year. The market share of galleries, auction houses, and art fairs accounted for 48%, 35%, and 15% of the market last year, respectively. There was also a significant change in the number of art fairs held in the country. In 2019, before the pandemic, 49 art fairs recorded 80.2 billion KRW. In 2021, the number of art fairs increased to 76, with an estimated size of approximately 154.3 billion KRW.

The influx of young artists and collectors brought about changes to the environment of the art market. The report found that the Korean art market has been active in rapidly adapting to technological changes such as NFTs (non-fungible tokens), DAOs (decentralized autonomous organizations), AI (artificial intelligence), and fractional investments in art. Over the past year and a half, numerous artists from all over the country have carried out projects and held numerous exhibitions based on these new technologies. As of May 2022, the total aggregate amount of fractional investments in art reached 100 billion KRW, just three years after the launch of the related platforms, and in the first quarter of 2022 alone, more than 31 billion KRW were invested.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.The report also mentioned the increase in branches of overseas galleries in the country. Following international mega-galleries such as Perrotin, Lehmann Maupin, and Pace, which opened branches in Seoul earlier, a number of other overseas galleries opened branches in the city, including Thaddaeus Ropac, König, Gladstone, Tang Contemporary Art, Peres Projects, and Esther Schipper. These galleries opened branches in Hannam-dong and Cheongdam-dong, predicting that the size of the Korean art market would more than double in the next five years.

Lastly, the report mentioned that many Korean corporations are expected to establish their own museums and art galleries in the coming years. This harks back to the 1980s and 1990s when it was a trend among large Korean corporations to establish their own cultural and artistic foundations.

Samsung’s Plateau, which closed in 2016, Art Sonje Center, Art Center Nabi, Sungkok Art Museum, Daelim Museum, and Kumho Museum of Art are some examples of those opened during this period, and they have served as major collectors in the Korean art market. Currently, more private art museums, such as the Amorepacific Museum of Art, Space K, and Paradise Art Center, have been added to the list. Though many conglomerates own museums, most corporate art museums in Korea are still in their early stages. Unlike national and public art museums, which mainly build their collections based on Korean artists, these private museums collect contemporary works by both Korean and international artists. However, the collections of these private museums greatly depend on the taste of the company owners or the business objectives of their parent companies.

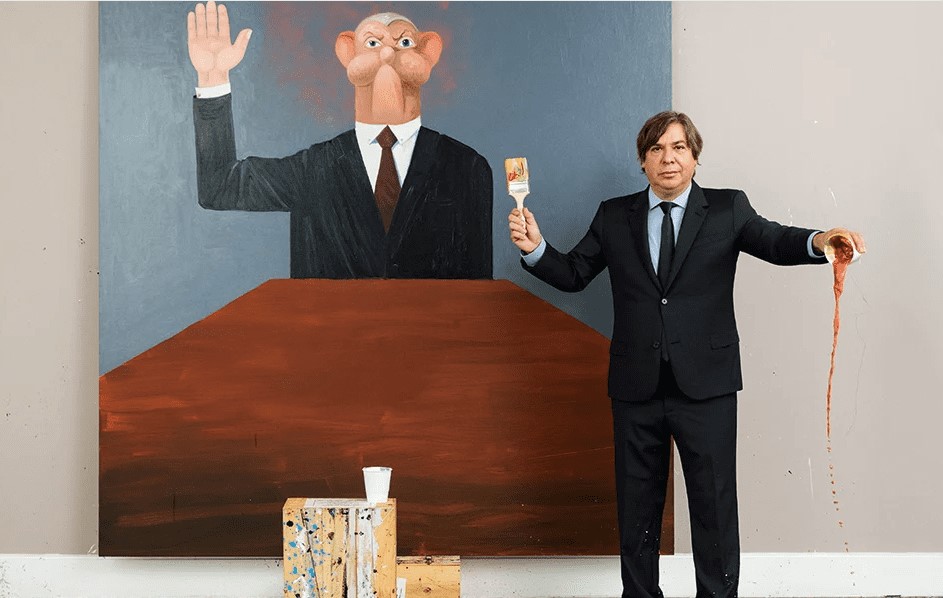

The report also included interviews with different art figures who have played an important role in the Korean art market in 2022, including Emmanuel Perrotin, owner and founder of Perrotin Gallery; Park Seo-Bo, a leading figure in the Dansaekhwa movement; and Choi Seung-hyun (aka T.O.P), a former member of the idol group Big Bang and an art collector.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.The writers of the report include Sang-Hoon Kim, dean of the Graduate School of Business at Seoul National University; Jieon Shim, director of the Visual Arts division of the Korea Arts Management Service (KAMS), Sang-In Cho, art journalist at the Seoul Economic Daily; Henna Joo, associate professor of the Graduate School of Arts and Cultural Management at Hongik University; Chungwoo Lee, art and design historian; Jung-Ah Woo, associate professor of art history at POSTECH; Kathleen Kim, an art lawyer; and Jeun Park, senior curator of Platform-L Contemporary Art Center.