The global art market in 2022 is estimated at $67.8 billion, an increase of 3% year-over-year. Yet, “results were more mixed in 2022,” with “variations in performance by sector, region, and price segments,” The Art Market 2023 report by Art Basel & UBS said.

Cover image of 'The Art Market 2023' report by Art Basel and UBS.

Cover image of 'The Art Market 2023' report by Art Basel and UBS.Noah Horowitz, CEO of Art Basel, explained in The Art Market 2023 that the global art market expanded in 2022 despite unstable global economic conditions, such as the continuing aftermath of the COVID-19 pandemic, disruptions in the global supply chain, inflation, and the swaying cryptocurrency market.

The Art Market 2023 is the seventh annual report released by Art Basel, the world’s leading art fair, and UBS, a Swiss financial company. This year’s report provides a review of the global art market in 2022, including fine art, decorative art, and antiques.

The global art market in 2022 is estimated at $67.8 billion, an increase of 3% year-over-year. This is an increase from $64.4 billion in 2019, prior to the outbreak of the COVID-19 pandemic. Yet, “results were more mixed in 2022,” with “variations in performance by sector, region, and price segments,” the report said. Also, the high-end market continued to be the main driver of growth in 2022.

The Global Art Market

Art Basel in Basel 2022. Courtesy of Art Basel.

Art Basel in Basel 2022. Courtesy of Art Basel.The United States continued to dominate the art market, accounting for 45% of global art sales by value in 2022, up from 43% in 2021, and exhibiting the highest pandemic resilience of all the major art markets. Sales in the US market reached an all-time high of $30.2 billion, an increase of 8% year-over-year.

The UK art market has grown by 1%, from 17% to 18%, reclaiming its second place from China. Despite extreme economic pressures and Brexit difficulties during the year, the UK art market saw a 5% rise in value to $11.9 billion. However, this falls short of the 2019 pre-pandemic level of $12.7 billion.

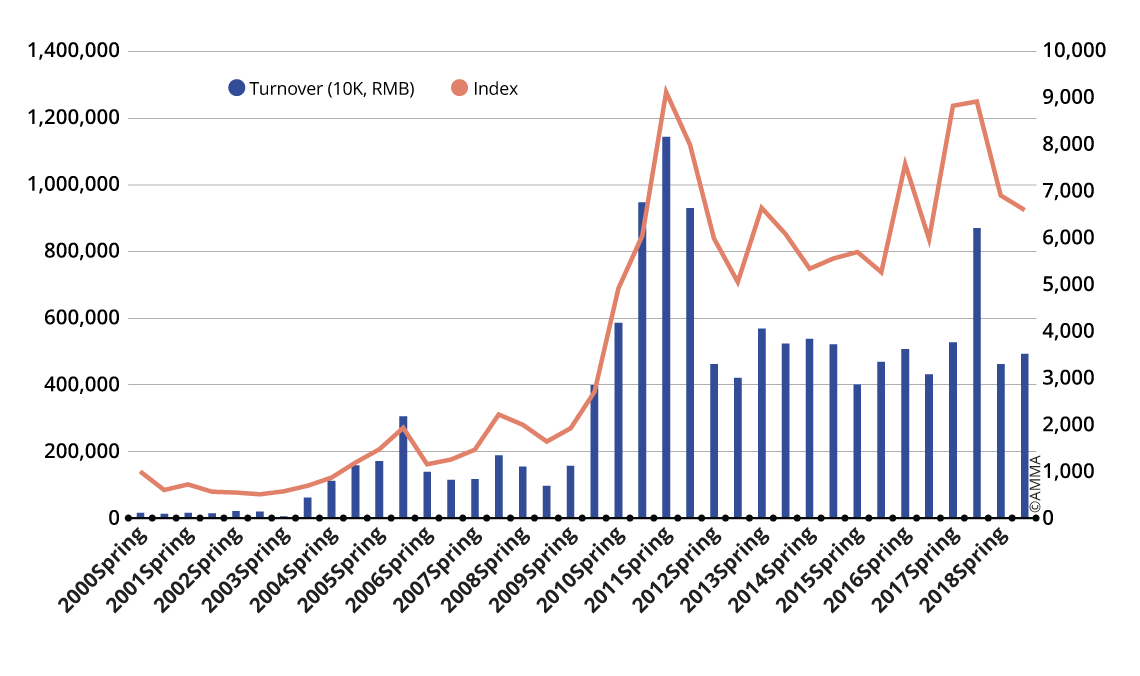

The Chinese market showed a strong recovery in 2021, but its size decreased by 3% in 2022, showing a 17% share of the global art market and taking third place. China had a difficult time in 2022, as many events were canceled or scaled back due to its “zero-COVID” policy. Compared to 2021, sales in China decreased by 14% to $11.2 billion. This result is still 13% higher than in 2020 but the lowest since 2009.

France remained the fourth largest art market in the world, accounting for 7% of the global art market. In 2022, the French market grew by 4% compared to the previous year. Although its growth was lower than in 2021 at 58%, it showed a positive result with an all-time high of $5 billion. Germany and Switzerland each accounted for 2% of the global art market, while Spain and Japan accounted for 1%.

In Korea, the inaugural Frieze Seoul, jointly held with the Korea International Art Fair (Kiaf), has greatly influenced the local art market, resulting in an increase in dealer sales, accounting for 1% in the global art market share. This is the first time South Korea has been included in the tally of the report.

Dealers

Paris+ par Art Basel 2022. Courtesy of Art Basel.

Paris+ par Art Basel 2022. Courtesy of Art Basel.Dealers saw the highest turnover in 2022, and reached an estimated $37.2 billion, up 7% from the previous year, which contributed to the overall size of the global art market.

According to the report’s survey, dealers in Asia showed the strongest sales performance. Dealer markets in Asia increased by 26% year-over-year, with sales increasing by 28% in Japan and 40% in Korea. In particular, with the opening of Frieze Seoul and Kiaf, various events were held within the country, attracting the attention of the global art market.

Based on survey responses, dealer sales in China increased by an average of 11%. However, this was mostly the case for mega dealers. In contrast, smaller businesses struggled in 2022.

The United States showed rather moderate growth of 6% year-over-year. South America saw a growth of 4% in 2022, which was considerably lower than the 21% increase in 2021. The share of Europe showed an increase of 17% in 2022. The UK showed a sluggish performance in sales in 2021 but saw a 22% increase in 2022. Dealer markets in other European regions also showed slow growth, but the Italian dealer market saw a 4% drop in sales.

In the dealer sector, galleries with a turnover of more than $10 million saw the biggest sales increase, up 19%, while those with a turnover under $250,000 fell by 3%.

In 2022, dealers reported sales of the single best-selling artist accounted for an average of 31% of total revenue, with the top three artists accounting for 51%.

미술품 경매 부문

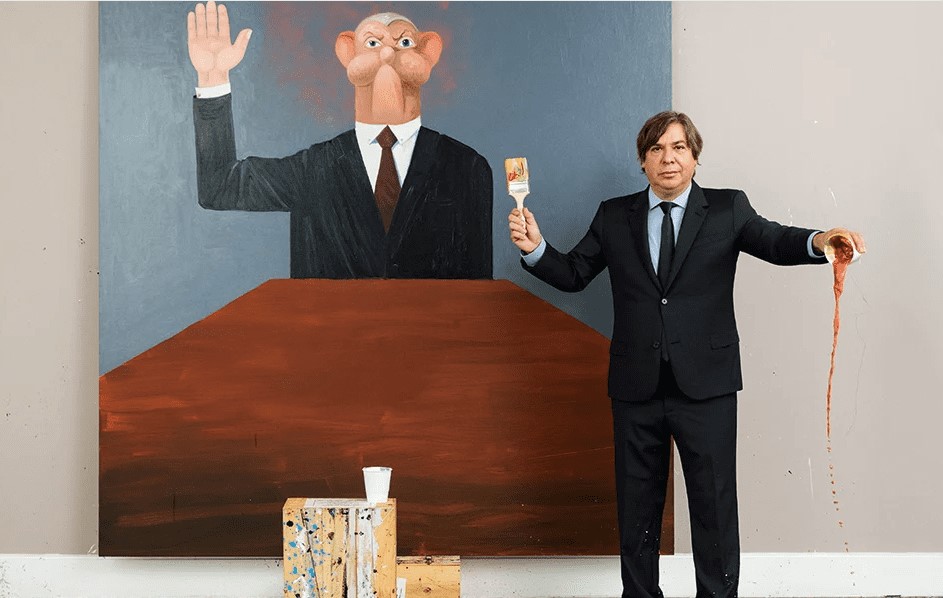

Arario Gallery. Artist Lee Ufan. Courtesy of Art Basel.

Arario Gallery. Artist Lee Ufan. Courtesy of Art Basel.Last year saw a number of record-breaking auctions, but the auction sector remains stagnant. The total size of public and private sales in 2022 was estimated at $30.6 billion, a decrease of 2% from $31.2 billion in 2021. Public auctions saw a slight decrease of 1% year-over-year to $26.8 billion, while private sales decreased to $3.8 billion. However, this is a 46% increase compared to 2020 and an 11% increase from the pre-pandemic period.

By country, the United States, China, and the United Kingdom remained the strongest auction markets, accounting for 76% of the total public auction market sales. The United States took first place with a 37% share of the auction market, followed by China with a 26% share, down 7%, and the United Kingdom with a 13% share.

Despite the economic downturn, Christie’s, Sotheby’s, and Phillips all recorded record-breaking sales last year, totaling $17.7 billion. In the art auction market, the number of works sold for more than $1 million was only 1% but accounted for 60% of sales, and artworks at auctions that were above $10 million accounted for 32%, indicating that ultra-high-priced works are still driving the market.

Works by post-war artists (those born between 1910 and 1945) and contemporary artists accounted for the largest share, accounting for 54% of the total 2022 art auction market. However, overall sales were down 8% from 2021, when they peaked at around $7.8 billion. Contemporary art by artists born after 1945 and works created within the past 20 years, particularly by ultra-modern artists, have doubled in value.

Art Fairs

Art Basel in Miami Beach 2022. Courtesy of Art Basel.

Art Basel in Miami Beach 2022. Courtesy of Art Basel.As many art fairs returned to in-person events with collectors visiting the sites, the number of art fairs held in 2022 resumed their pre-pandemic levels. The number of live art fairs was 346, an increase of a third compared to 2021 but still 62 fewer than in 2019.

The share of art fairs in sales increased significantly from 27% in 2021 to 35% in 2022 but still fell short of pre-pandemic levels (42% in 2019). Gallery sales accounted for 47%.

In the 2022 art fair market segment, Asia accounted for 9% of the global market, and China accounted for 3%. New art fairs, such as Frieze Seoul and ART SG, opened in 2022 and early 2023, but the total number of art fairs in Asia decreased by 11% (or four fairs) from 2019 to 2022.

The United States was the region that held the most art fairs, accounting for 24% of art fairs held worldwide. The number of fairs held in Europe accounted for 53%, with the UK accounting for 12% and France for 10%.

Online Art Market & NFT Art

Photo by Bjorn Pierre on Unsplash.

In 2022, both the dealer and auction sectors saw a downturn in online-only sales. With exhibitions, auctions, and art fairs returning to in-person events, online-only sales fell to $11 billion, a decrease of 17% from 2021’s $13.3 billion. However, online sales are still 85% higher than in 2019.

The NFT art market has decreased by 49% since its peak at the end of 2021 (around $2.9 billion) to less than $1.5 billion, showing the most dramatic decline compared to other sectors. However, this is still a 70-fold increase compared to NFT sales in 2020, which were just over $20 million.

Although the NFT art market saw a decline, it accounted for 5% of dealer sales in 2022, up from 1% in 2021, due to the growing institutional recognition of NFT-related art and artists’ continued engagement with the medium.

Transactions of NFT art in the primary market fell by 12%. However, the number of buyers of NFT works in the secondary market increased by 14%.