Cover image of "Analysis of Korean Millennial and Generation Z Art Collectors(한국 MZ세대 미술품 구매자 연구)," commissioned by the Korea Art Management Service (KAMS).

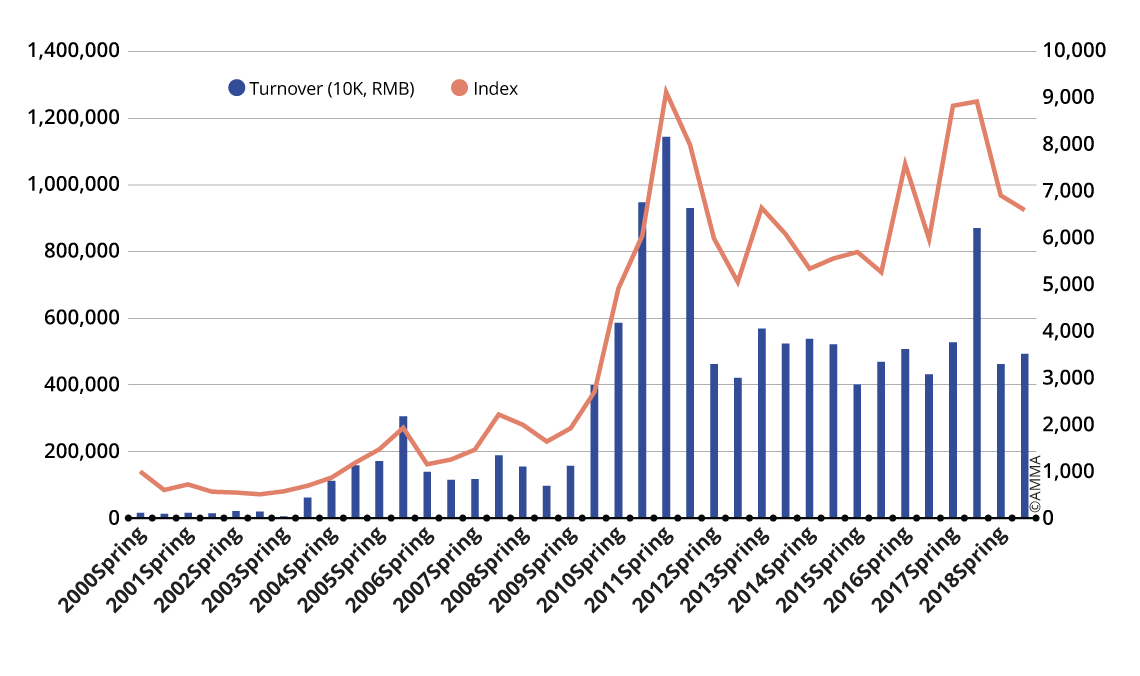

Cover image of "Analysis of Korean Millennial and Generation Z Art Collectors(한국 MZ세대 미술품 구매자 연구)," commissioned by the Korea Art Management Service (KAMS).UBS and Art Basel’s Art Market Report, which analyze the global art market, mentioned the size of the Korean art market for the first time mentioning that South Korea represented 2% of the value of the Post-War and Contemporary sectors in 2021. Its size exceeded 900 billion KRW, more than double that of 2019 and 2020.

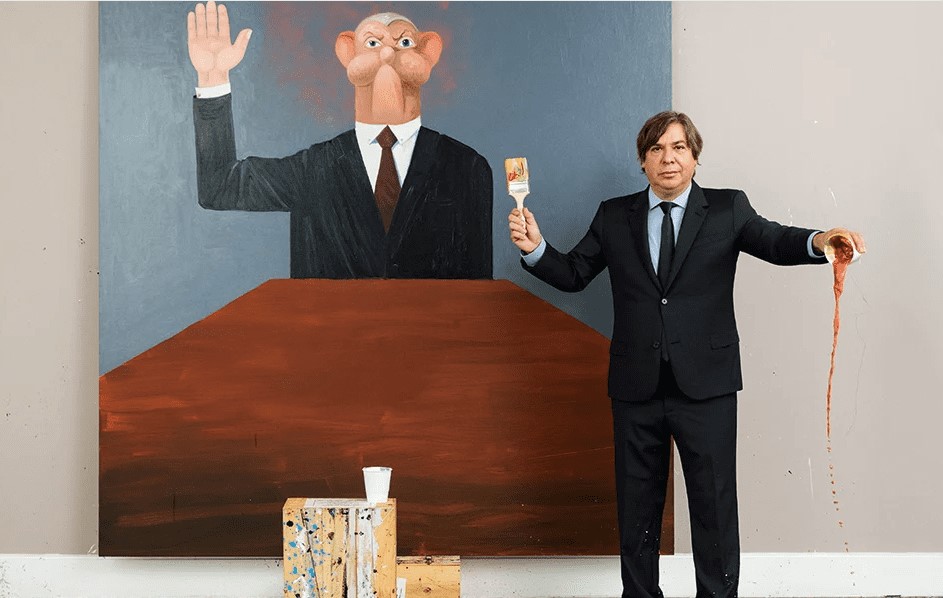

Many market experts say that young collectors are the driving force behind the rapid growth of the Korean art market.

To determine the market influences and consumption characteristics of these young Korean collectors, the Korea Arts Management Service (KAMS) published a research report titled Analysis of Korean Millennial and Generation Z Art Collectors in September. Associate Professor Yeonhwa Joo of Hongik University’s Graduate School of Culture and Arts Management conducted the report. And a summary of the research was presented at a seminar on the Korean art market held by the KAMS on November 30.

The study analyzed the responses of 1,361 people who responded to a questionnaire and interviewed young buyers and art dealers to examine their purchasing behaviors and learn more about these young Korean collectors.

Respondents were divided into four generations: Generation Z, born between 2005 and 1996; Millennials, between 1995 and 1980; Generation X, between 1979 and 1965; and Baby Boomers, or Generation B, between 1964 and 1946.

The report compared the MZ generation to the XB generation to determine the purchasing characteristics of the MZ generation. In addition, the report distinguished the top MZ collectors from other MZ collectors. These top MZ collectors have spent over 100 million won (approximately $80,000) on art over the past three years.

Kiaf PLUS 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf PLUS 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.Across all generations, 65% of collectors were female, and Seoul residents accounted for 61.7%. In the MZ generation, 63.1% of collectors were female, which is 1.4 times more than men. The proportion of female collectors among the top buyers of the MZ generation decreased slightly but remained higher than that of male collectors.

A total of 82.1% of respondents indicated that they were employed, with 23% working in an office or as an engineer and 19.5% working professionally. In the case of the MZ generation, office workers and engineers accounted for 21.6%, and professional workers accounted for 30.4%. The average monthly income of the MZ generation was less than 5 million Korean Won (approximately 4,000 US dollars), while most of the top MZ collectors earned an average monthly income of 50 million KRW or more.

The average MZ collector purchased 7.5 works per year, whereas the average XB collector purchased 10.7 works. The top MZ collectors purchased 20.8 works, which was approximately three times more than all MZ purchasers.

The average MZ collector purchased artworks for less than 5 million KRW, while 80% of the top MZ collectors reported purchasing artworks for 10 million KRW or even over 50 million KRW. Approximately 80% of the top MZ collectors purchased works totaling between 100 million and 500 million KRW. Respondents who reported spending over 500 million KRW accounted for 19.6%.

The favorite genre for all generations was painting, and the majority of generations preferred purchasing artworks by Korean artists. However, the top MZ collectors preferred works by international artists, particularly those from Europe and the US, as well as blue-chip Korean artists. The average MZ collector preferred works that were visually intense and easy to understand. And due to their limited income, many of them purchased drawings and editions, whereas the top MZ collectors purchased a large proportion of sculptures.

Regarding the purchase channel for artworks, the MZ generation showed a distinct pattern compared to the XB generation. The average MZ collector made the majority of their purchases at art fairs. In particular, Generation Z demonstrated a preference for purchasing artworks directly from artists through social networking services.

Unlike the average MZ collector, top MZ collectors preferred purchasing works through private sales at domestic galleries over purchasing works at art fairs. Top MZ collectors tended to purchase works by referring to auction information and receiving recommendations from galleries and art dealers, showing a tendency to purchase works recommended by experts.

Kiaf PLUS 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf PLUS 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.This pattern was also revealed in future purchasing plans. Top MZ collectors hoped to acquire works by internationally renowned artists from outside of Korea, and they were highly willing to use international galleries rather than Korean galleries as their purchasing channel. As these top MZ collectors have fewer language barriers, 17% of them have bought artworks from overseas galleries, and 65% of them intend to do so in the near future. On the other hand, only 20–30% of the other generations, including the average MZ collector, responded that they would like to contact overseas galleries.

All generations indicated that the primary reason for purchasing art is appreciation. Interior decoration was the second highest purpose for the average MZ collector, but the top MZ collectors responded that their second purpose was for long-term and short-term investment and inheritance. The purpose of investment is revealed by the fact that 50% of the top buyers have resold works within the past decade.

To gain a better understanding of the characteristics of the top MZ collectors, the KAMS conducted interviews with approximately ten people and various dealers.

According to the in-depth interview, most top MZ collectors bought artworks worth an average of 200 million KRW (approximately 150,000 USD) per year over the past three years. Some of these collectors reported spending between 1 billion KRW and 5 billion KRW per year. The most expensive collections consisted primarily of works by ultra-contemporary artists born after 1974 with international recognition or blue-chip Korean artists from the Dansaekhwa group, priced between 300 and 500 million KRW.

Top MZ collectors who had experience reselling their collections reported a 100% return. However, according to interviews with the dealers, these gains appear to be the result of the market’s upward trend over the past five years rather than the fact that MZ’s top collectors have a keen eye for artistic and historical pieces.

When purchasing artworks, the top MZ collectors generally consider personal satisfaction, interior decoration, investment, and economic benefits, such as tax benefits. In particular, these buyers prioritize value investing.

While these top MZ collectors appreciated the historical significance, originality, and artistic quality, dealers did not consider them to have sufficient art and investment knowledge.

Kiaf PLUS 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf PLUS 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.The MZ generation played a significant role in spreading the culture of buying and collecting art as an interesting activity. However, they lack prior art market experience. Rather than professional groups with expert knowledge of the art market, most MZ generation collectors are heavily influenced by online communities or influencers. Therefore, although they are the key generation that leads and controls the Korean art market, these collectors are vulnerable due to a lack of experience and knowledge.

The significance of the KAMS study on MZ collectors lies in its analysis of the characteristics and purchasing behaviors of these young collectors. However, some experts remarked that this study was conducted when the Korean art market was still growing, thus lacking the expected trends of young collectors when the market is declining.

Until September, when the KAMS published its research report, it was anticipated that these younger generations’ art purchases would last longer. However, these projections are being significantly revised.

Stocks, real estate, and virtual assets have all plummeted due to the economic recession. As a result, the Korean art market, which had experienced rapid expansion, has entered a period of adjustment. Lee Han-bit of Herald Corporation, a Korean news platform, proposed some insightful analysis of the current trend among art collectors of the MZ generation.

The majority of younger collectors purchased artworks for investment purposes. Now that the art market is showing a downward trend, experts are questioning whether they will remain in the art market.

Virtual assets accounted for a significant portion of the assets of younger generations, and the collapse of this market has weakened the Korean art market. “Until last year, there were quite a few collectors who bought works by directly selling cryptocurrency in the market. However, it is difficult to find such collectors this year,” said a director of a gallery that represents young artists.

Fractional ownership has introduced new players to the art market, such as the MZ generation, who do not have large assets. As a result of Korea’s Securities & Futures Commission classifying fractional ownership in art as “securities,” it is anticipated that the size of this market will decrease as well. Related art investment companies such as TESSA, Seoul Auction Blue, ArtTogether, and Yeolmae Company have stopped their services. They can only be resumed if consumer protection measures can be provided within six months.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.It is anticipated that the overall number of collectors from the MZ generation will undergo a significant change. If their consumption decreases due to the economic downturn, the size of the Korean art market will inevitably decrease as well.

As mentioned in the research report, the younger generation had fewer chances to develop their taste based on the art historical value of artworks or to understand the various purposes of art collections. Instead, they primarily purchased art for personal appreciation, interior design, and investment. Thus, the size of the art market will inevitably get smaller, especially if young collectors lose interest in buying art or cannot find further significance in art collecting.

To create a more sustainable art market, many experts, including the report, suggest that the Korean art world should provide reliable information on Korean contemporary art so that both Korean and international collectors can better understand its history, as well as provide various examples of art collections to younger buyers.