The South Korean art market is currently facing a downturn, yet the financial sector is showing increased interest in the art market. This is due to the diversification of investment opportunities in artworks using virtual assets.

Image byTatiana Rodriguez on Unsplash.

Image byTatiana Rodriguez on Unsplash.There aren’t many people who think that art and capital are separate entities anymore. The art market, while still small in comparison to other financial markets, has developed remarkably over the past few decades. Today, artworks no longer exist solely for the private appreciation of a few enthusiasts like the aristocracy of the past, nor it only appears in public exhibitions. Art is now an investment with a market value that can increase profits.

In the present day, individuals acquire and invest in based not only on their own desires and tastes but also the desires and tastes of the market. Many collectors now approach art purchases with the mindset of an investor, examining portfolios prepared by art fund managers or dealers. Unlike the aristocrats of the past, who possessed a refined aesthetic sensibility, these collectors adopt a bold investment attitude toward their assets when acquiring artworks.

Image by Stephen Dawson on Unsplash.

Image by Stephen Dawson on Unsplash.The financialization of art has transformed various aspects of the art world. It has not only redefined the identity of artists and the ways art is enjoyed but has also brought about changes in the social position of art and the institutions and policies surrounding it. Art is now subject to the fluctuations of various indices, including production and sales, prosperity, and downturns, reflecting the ever-changing dynamics of the art market.

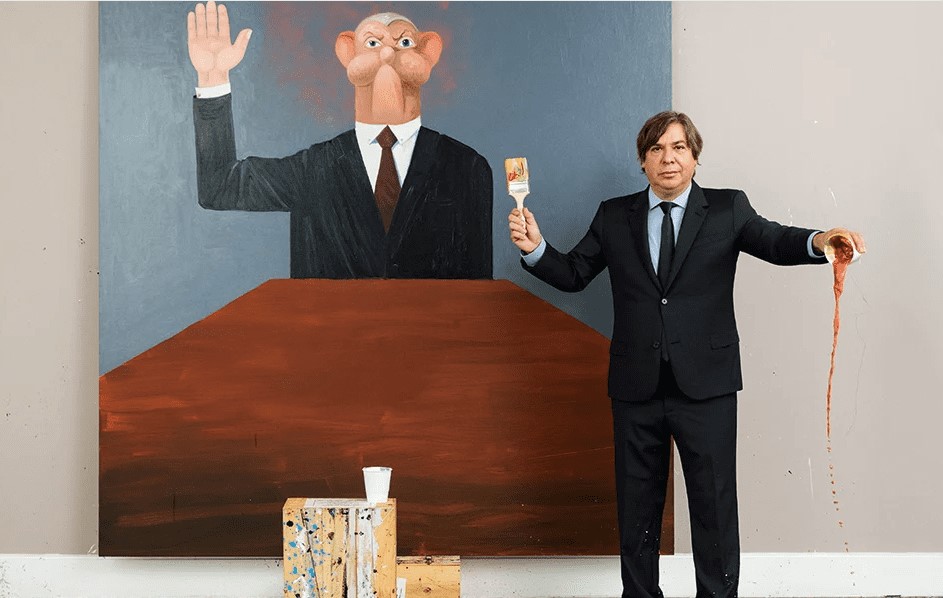

Due to these trends, we also use different terms to describe artists. We refer to artists who have both historical art significance and market prominence as “blue-chip artists” and those who are rising in the market as “emerging artists.” Artists’ identities have also evolved. Artists like Damien Hirst, Jeff Koons, Takashi Murakami, KAWS, and others have become brands in themselves. They are not just artists but also stars, often taking on roles similar to CEOs running a corporation.

The nature of exhibitions has also changed. Many art museums pursue the popularization of art and host blockbuster exhibitions to achieve box-office-like results. Governments implement various policies, including tax benefits, to facilitate the smooth trading of artworks. Even the way we appreciate art has been affected. Now, the criteria for judging the beauty of artwork include financial performance. People don’t just buy art based on visual appeal; they also consider the rumors and investment value surrounding the work. Art has become a noteworthy asset akin to securities or an investment instrument that enables tax optimization.

We shouldn’t view these changes solely in a negative light, as the nature of art evolves with the times. However, there are dynamics of which we should be mindful. The art market has long been one of the markets investors have avoided due to its opacity, volatility, high transaction costs, relatively small market size, illiquidity, and lack of regulation. Therefore, it was expected that the art market would become more transparent and clearer as it became financialized.

Kiaf SEOUL 2023. Photo by Aproject Company.

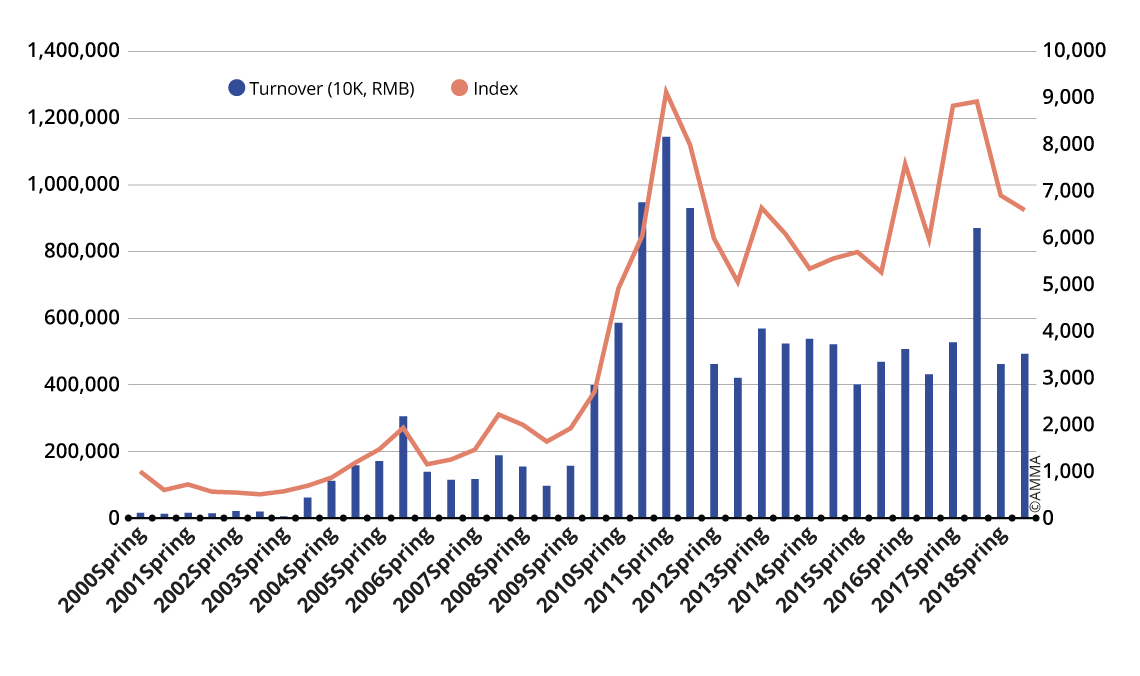

Kiaf SEOUL 2023. Photo by Aproject Company.Paradoxically, the art market is increasingly becoming an area for experts. Art now follows various indices that, as mentioned earlier, change constantly. This phenomenon is evident in all art fields, but it is most pronounced in the art auction sector. Tracking artwork prices in auctions today is a challenging task, and the art auction market has become a mysterious place for everyone except auction houses, a few financiers, and their agents and intermediaries.

While commercial galleries do not disclose prices for sold works, auction houses have published prices for artworks. Many auction houses have raised the buyer’s premium several times within a year, making it difficult to compare prices year over year. They also tend to emphasize the prices of top-selling lots with significant premiums while not disclosing works that were unsold or withdrawn. Major auction houses like Christie’s and Phillips have reduced or discontinued the production and distribution of auction catalogs since 2020. All of these factors have made understanding the mechanisms behind how artwork prices are formed increasingly challenging.

Image of 'The Artnet Intelligence Report, Mid-Year Review 2023.' Image by Village Green.

According to the Artnet Intelligence report, as the auction market has become increasingly opaque to everyone except a few insiders, the performance of high-value artworks, especially those that sell for over $10 million, has become more important than ever. According to Artnet’s price database, in 2022, artworks selling for over $10 million accounted for the largest share of the art auction market by value, and this price range was the only one that saw an increase in total sales compared to the previous year.

This trend is expected to be accentuated further with economic instability as more individuals seek safe investments rather than taking risks. Consequently, there is an expected focus on stable “blue-chip” artists rather than ultra-contemporary artists, and established art markets like New York, London, and China are likely to receive more attention than emerging ones. This trend is not limited to the auction market alone. This year, Frieze Seoul received praise for featuring stable artworks, namely those by renowned artists. Additionally, Frieze recently acquired the Armory Show in New York and Expo Chicago. It will be important to closely monitor how these developments will impact the Korean art market in the future.