The global art market, including the Korean art market, has entered a period of adjustment. However, how we deal with this process will allow us to take a new leap forward.

Kiaf SEOUL 2022 at COEX, Seoul. Courtesy of Kiaf SEOUL.

Anything that goes uphill will also go downhill. The art market is no exception. The South Korean art market, which had been red-hot until 2021, gradually began to cool off in early 2022. Numerous media outlets have warned against approaching the latter half of 2022 with an optimistic outlook as the market enters a period of stagnation.

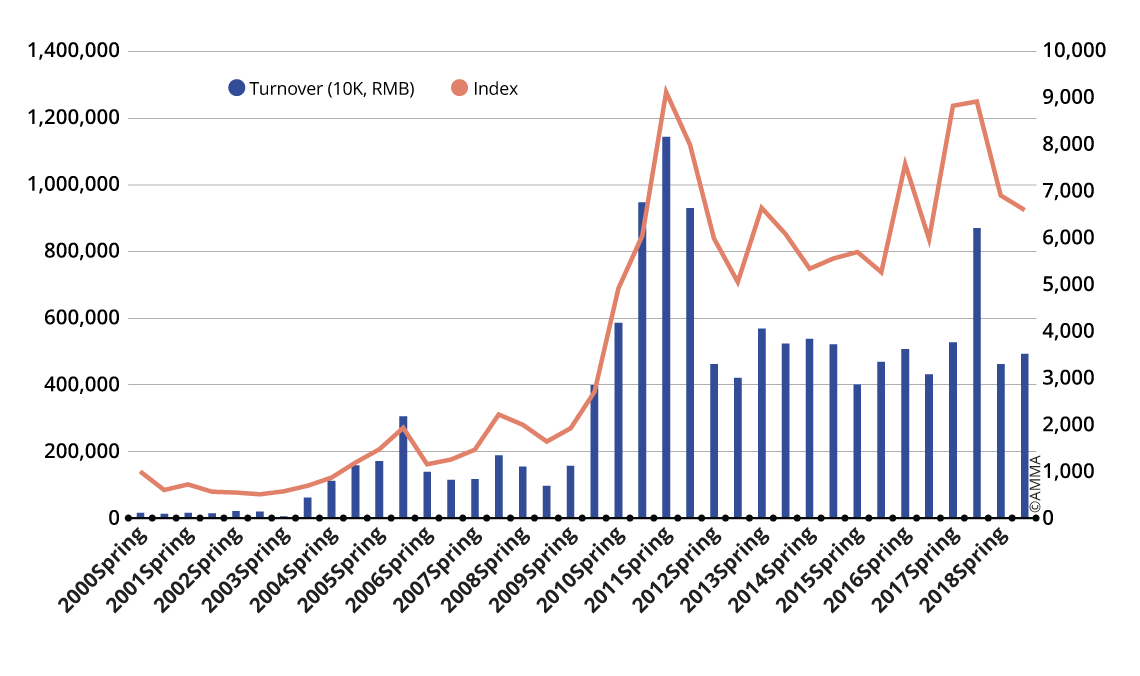

The economic downturn has not solely affected the Korean art market; the downturn has resonated across the global art market, which is also showing signs of cooling off. The Art Market Report, 1H 2023, published by Korea Art Authentication & Appraisal Inc. (KAAAI), identifies factors such as the ongoing conflict in Ukraine, prolonged inflation, and currency tightening as the causes of this adjustment period in the global art market.

The art auction market is where we can most easily observe this adjustment period in the art market.

A man bids on a work of art at Seoul Auction. © Seoul Auction.

A man bids on a work of art at Seoul Auction. © Seoul Auction.Art Auction Market

According to KAAAI, the combined sales of the world’s top three auction houses, Christie’s, Sotheby’s, and Phillips, amounted to approximately $5.81 billion (including buyer’s premium) in the first half of 2023. This is a decrease of 18.2% compared to the hammer prices of approximately $7.11 billion in the same period of the previous year.

Despite a decline in the total sales of the global auction market, the number of auction events and successful bids increased. The number of auctions rose from 419 in the first half of 2022 to 452 in the first half of 2023, and the number of successful bids increased from 51,073 in the first half of 2022 to 53,100 in the same period of this year.

However, the average price of the successful bids decreased. The average hammer price dropped from $139,173 in the first half of 2022 to $109,485 in the corresponding period of 2023.

This trend, according to KAAAI’s analysis, reflects the defensive psychology of buyers amid market uncertainty. In fact, online sales with relatively low entry barriers have increased. Among the genres, prints and editions with relatively lower price ranges saw a 22% increase compared to the previous year.

Sotheby's auction. Image by Singulart/ Alyssa Perrott.

New York, London, and Hong Kong are the three largest hubs for global art auction sales, accounting for 86% of the total market. So, how have the market sizes of these three cities changed?

In the global art auction market, New York constituted 50.1% of total sales, marking a 22% decrease compared to the first half of 2022. London accounted for 18.9% of total sales, experiencing a 25.1% decrease from the same period last year. However, Hong Kong saw an increase, rising from 15.8% of total sales in the first half of 2022 to 17.0% this year.

When assessing the global context, it is essential to examine South Korea’s situation. The KAAAI reported the total hammer price for Korean auction sales in the first half of the year to be approximately 61.371 billion KRW. This represents a significant decrease of about 47.03% compared to the same period in the previous year. The success rate was around 71.24%, marking a decline of approximately 10.96% year-over-year. The quantity of sold artworks decreased by approximately 8.45% to 1,625 pieces compared to the corresponding period last year.

Regarding the current adjustment period in the Korean art market, the Korea Arts Management Service (KAMS) presented various viewpoints. KAMS gathered art experts to hold a panel discussion to review the state of the Korean art market in the first half of 2023 and forecast trends for the second half of the year.

The May 2020 Auction at K Auction. © K Auction.

The May 2020 Auction at K Auction. © K Auction.At the panel discussion, in light of this adjustment phase in the Korean art market, Shim Sun Young, the Director of the Gallery Grimson, has evaluated that the art market is returning to levels similar to those in 2019, following a period of excessive market overheating. According to her, new collectors, who had shown significant interest in art investment, actively purchased works during the boom but are now encountering difficulties in reselling those acquired pieces, resulting in a slowdown of the market. Journalist Jo Sang-in has assessed that the reduced transactions of high-value artworks have further contributed to the contraction of the market size.

Both the Korean and international auction markets are clearly experiencing a downward trend. Even art fairs, while not as transparent in terms of sales trends as auctions, have shown similar tendencies. However, the situation in the Korean art fair market has exhibited a divergence from this trend.

Frieze Seoul 2022, COEX, Seoul. Photo by Aproject Company.

Frieze Seoul 2022, COEX, Seoul. Photo by Aproject Company.Art Fair Market

One of the prominent characteristics of the recent boom in the global art market is the rapid rise of “ultra-contemporary art,” a term referring to contemporary artists under the age of 40. However, current trends in the art fair market, driven by the effects of the downturn, have been more inclined to highlight quality works from established blue-chip artists rather than promote emerging, riskier artists.

This trend was evident at Art Basel in Basel, one of the most prestigious art fairs where the flow of the global art market can be discerned. Major galleries participating in Art Basel showcased works by young artists in 2022, but this year, the focus has moved toward classic blue-chip artworks.

KAAAI have concluded that the art market, which had experienced excessive fervor, is now gradually returning to a more stable trajectory. In this transitional phase, with the heat subsiding, numerous galleries are choosing a more secure direction.

The Preview in Seongsu 2023. Photo by FromA.

The Preview in Seongsu 2023. Photo by FromA.On the other hand, the atmosphere in the Korean art fair market still appears to be positive. As reported by KAMS, Cho Yun-young, the CEO of Art Meets Life, who hosted The Preview in Seongsu last April, reported that this year’s sales have actually increased by approximately 25% compared to the previous year. Cho observed that while the overall size of Korea’s art market has shrunk, the passion for art persists. Attendance at Korean art fairs, in fact, is showing an upward trend compared to the bustling year of 2022.

Urban Break 2023, which took place from July 13 to 16, attracted over 60,000 people, an increase of more than 10,000 people from the previous year. Both The Preview and Urban Break art fairs target the younger generation, namely Millennials and Generation Z, by showcasing artworks that resonate with their tastes and are available at slightly more accessible price ranges.

This outcome demonstrates resilience, but for the Korean art market to survive in such an adjustment period, enhancing market stability and sustainability is crucial.

The Korean art scene must broaden its focus beyond the domestic market and venture into the international market. During a discussion at KAMS, Professor Henna Joo from Hongik University emphasized the need to transform the Korean art market into a platform, creating opportunities for Korean art to expand globally. She also mentioned the importance of devising strategies to attract collectors from China, the leader in the Asian art market. In the global era, relying solely on the domestic market will not scale up the market size, and sustaining the art market through domestic consumption alone poses challenges.

Both the Korean and global art markets are entering an adjustment period. However, depending on how this process is navigated, it could potentially serve as a stepping stone for a new leap forward.