During prosperous times in the art market, buyers would anticipate that the value of pieces by contemporary artists would rise. However, during downturns, it is difficult to have the same expectations.

Gerald Fineberg's apartment at the Mandarin Oriental Boston. Photo: Jack Vatcher/ Artnet News.

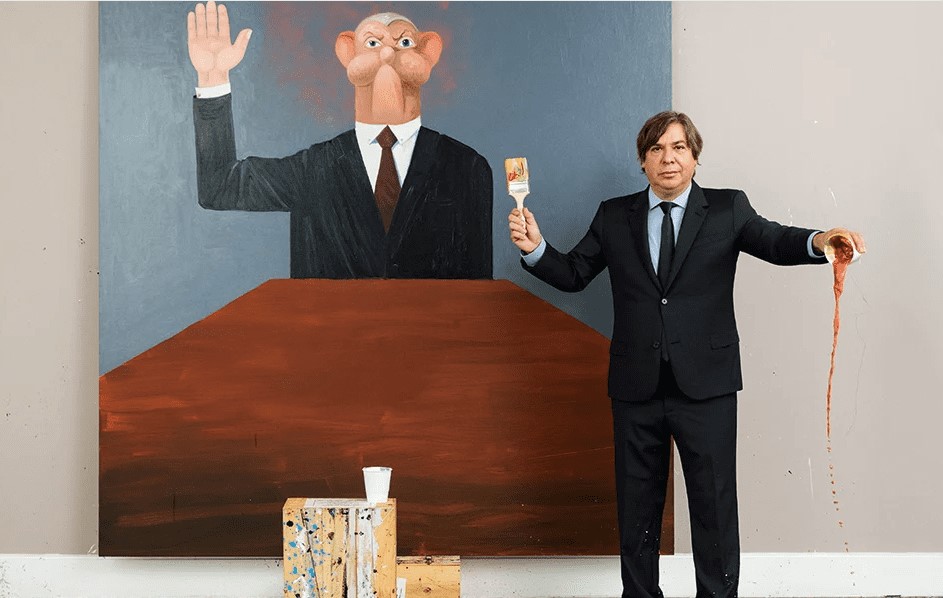

Gerald Fineberg's apartment at the Mandarin Oriental Boston. Photo: Jack Vatcher/ Artnet News.The auction held at Christie’s New York on May 17 featured the collection of the late real estate magnate Gerald Fineberg, who passed away in December. While the heirs anticipated substantial gains from this auction, the results were below expectations.

Works by prominent figures in the contemporary art world, such as Gerhard Richter, Lee Krasner, Willem de Kooning, Christopher Wool, Lucio Fontana, Roy Lichtenstein, and others, were auctioned off at prices below even their lowest estimates. On the other hand, pieces by superstars like Mark Grotjahn, James Rosenquist, Louise Bourgeois, and Martin Kippenberger failed to attract buyers.

The Gerald Fineberg Collection, which was expected to generate up to $270 million, only reached $210 million. The May auction at Christie’s revealed a noticeable decline in the art market.

Sotheby’s New York Contemporary Art Evening Auction, 12 May 2015. Works shown: Christopher Wool, 'Untitled (Riot),' 1990; Mark Grotjahn, 'Untitled (Into and Behind the Green Eyes of the Tiger Monkey Face 43.18),' 2011; Roy Lichtenstein, 'The Ring (Engagement)'; Andy Warhol, 'Superman,' 1981. Photo courtesy of Sotheby’s.

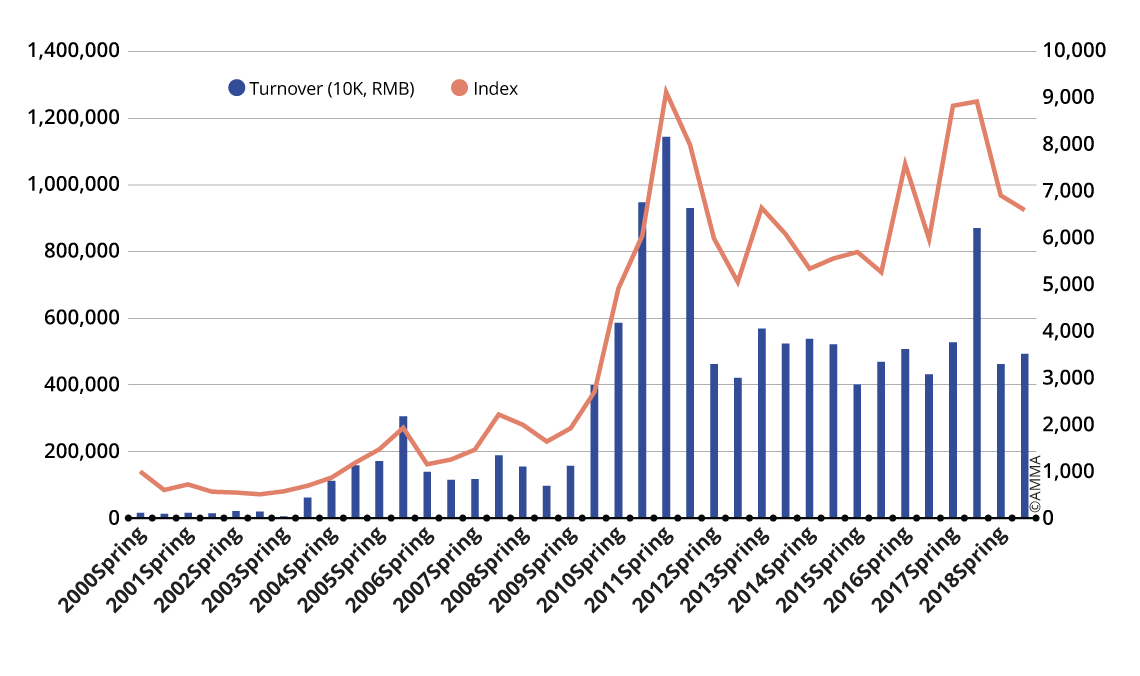

Sotheby’s New York Contemporary Art Evening Auction, 12 May 2015. Works shown: Christopher Wool, 'Untitled (Riot),' 1990; Mark Grotjahn, 'Untitled (Into and Behind the Green Eyes of the Tiger Monkey Face 43.18),' 2011; Roy Lichtenstein, 'The Ring (Engagement)'; Andy Warhol, 'Superman,' 1981. Photo courtesy of Sotheby’s.According to the Artnet Intelligence Report, global auction sales from January 1 to May 20 amounted to only $5 billion, marking a roughly 14% decrease compared to the same period last year. Sotheby’s and Christie’s both achieved sales of $1.7 billion, while Phillips reported $2.549 million. This marked a 22% drop relative to the same period in 2022.

However, according to Artnet, the phenomena occurring in the art auction market are not entirely negative. This period is actually favorable for collectors and museums to expand their collections. Galleries have seized the opportunity to acquire works by artists they represent at more affordable prices. David Zwirner acquired an Alice Neel piece, Gagosian purchased a work by Wool, Skarstedt secured a de Kooning, and Jeffrey Deitch obtained a Basquiat, as reported by The Baer Faxt.

The Intelligence Report quoted various art market experts, noting a shift in purchasing behaviors. Rather than impulsively buying based solely on an artist’s fame regardless of the price, collectors now weigh factors like the artwork’s quality, its price, and its novelty.

The report quotes Philip Hoffman, the Fine Art Group CEO, as stating that “anything uncommercial, anything out of fashion—it’s zero interest. The wrong Picasso, the wrong Magritte, the wrong Cézanne—no interest. The right Van Gogh—huge interest.”

A person bids on a work of art at Seoul Auction. © Seoul Auction.

The report suggests that a central consideration is the altered value of money. Over time, the art auction market has seen increasing financialization. Artworks, traditionally viewed as cultural treasures, have evolved into financial assets. Consequently, the art market now finds itself intertwined with the broader financial world, its institutions, and specialists. With the financialization of the art auction market, the financial sector has engaged in various activities to generate profits using the opaque trading methods of the art market.

During periods of reduced interest rates, art loans were actively utilized. However, in the current high-interest rate environment, obtaining the same amount of loan now costs three times more than it did a year ago. Since there is no immediate profit in trading artworks, people are turning their attention to stocks instead.

This trend is also significantly impacting the genres preferred by buyers. Previously, works by ultra-contemporary artists, those born after 1974, garnered much attention. However, the current trend sees buyers gravitating toward more established, classical pieces. Compared to 2022, sales of ultra-contemporary artworks have witnessed a decline of 26%.

The May 2020 Auction at K Auction. © K Auction.

The May 2020 Auction at K Auction. © K Auction.The shifts in the Korean art market mirror these global changes. According to the Korea Art Price Appraise Association, the sales volume of the Korean art auction market in the first half of this year amounted to approximately 81.1 billion KRW. This indicates a substantial downturn, with current sales equating to just 56% of the sales during the same period in the previous year (144.6 billion KRW).

The art market in Korea has also experienced fluctuations, but modern artworks from the late 19th century to the 20th century remain popular. In June, the overall success rate of auctions at Seoul Auction reached 67%. However, for modern art, out of the 15 items offered, 12 were sold, achieving an 80% success rate.

During prosperous times in the art market, buyers would anticipate that the value of existing pieces by contemporary artists would rise. However, during downturns, it is difficult to have the same expectations. As a result, more classical modern works are receiving attention. While antiques are also favored, they typically command higher prices. Hence, industry analysis indicates a growing emphasis on more affordable, smaller pieces in the realm of modern art, which are usually more cost-effective.

References

- 한국 미술품 감정연구센터(Korea Art Authentication & Appraisal Inc., KAAAI)

- Artnet News, Introducing: The Artnet Intelligence Report, Mid-Year Review 2023, 2023.08.11

- Artnet News, Correction in Motion? Christie’s First Sale of Gerald Fineberg’s Collection Pulled in $153 Million, Falling Far Short of Presale Estimates, 2023.05.18

- CHRISTIE’S, Christie’s Delivers Solid Performance in Changing Macro-environment, 2023.07.12