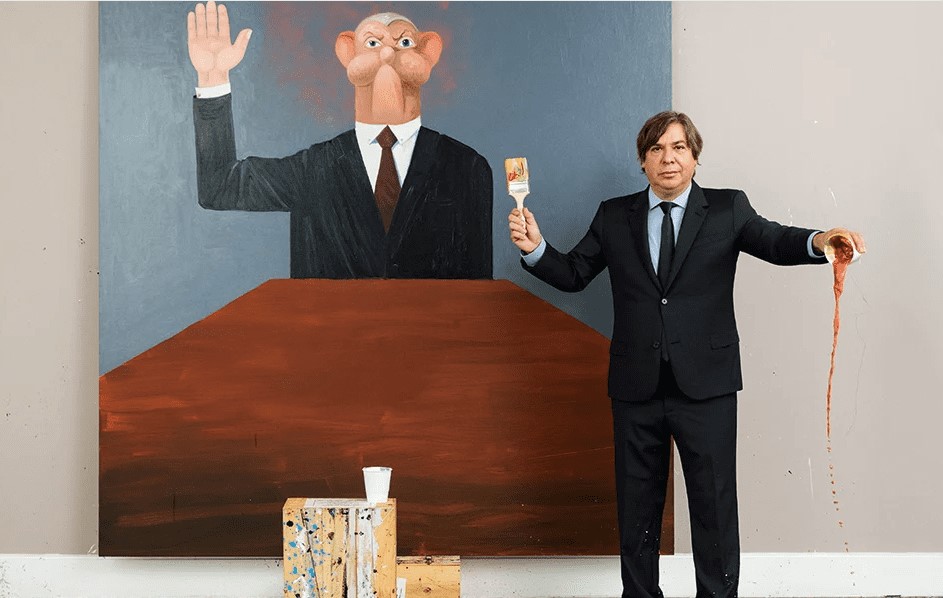

Image by Jon Tyson on Unsplash.

Image by Jon Tyson on Unsplash.The number of income tax assessments on art transactions surged 36 times in a year, yet the actual tax collected only increased by 1.7 times, raising concerns about the fairness of taxation on art, which is often exempt or subject to reduced tax rates.

According to data obtained from the National Tax Service by Representative Han Byungdo, a member of the ruling Democratic Party’s Planning and Finance Committee, the number of income tax assessments on art transactions has fluctuated in recent years, with a sharp increase in 2021 that led to 8,980 cases compared to the 251 cases in 2020. However, the taxable amount increased from 37.47 billion KRW in 2020 to 62.92 billion KRW in 2021, representing only a 1.7-fold increase.

Under current regulations, art items valued at less than 60 million KRW are not subject to income tax, and works by surviving domestic artists are exempt from tax regardless of their value. Additionally, even when tax is applied (at a 22% rate after deductions of 80-90% of the transfer price), this income is classified as “other income” and is not aggregated into the total income. High-income individuals are making the most of these tax exemptions, with the top 10% of transfer amounts in 2021 accounting for 99% of the total (226.36 billion KRW), and the top 1% alone contributing to over half of the total (158.01 billion KRW).