The South Korean art market is currently facing a downturn, yet the financial sector is showing increased interest in the art market. This is due to the diversification of investment opportunities in artworks using virtual assets.

Image by Mathieu Stern, Unsplash.

Image by Mathieu Stern, Unsplash.While it might take some time for active trading to pick up, the Financial Services Commission has approved security token offerings (STOs) that issue cryptocurrencies backed by corporate assets. This move allows for the issuance and distribution of tokenized securities based on distributed ledger (blockchain) technology and paves the way for legislative changes.

Tokenized securities refer to the use of blockchain technology to create individual data blocks for various transaction information, connecting them like a chain. This results in digital records that allow all investors to view transaction information.

With the authorization of STO issuance, even non-securities firms can become token issuers and account management entities if they possess a certain level of capital and personnel. The approval of STO issuance is expected to lead to the development of a new asset market.

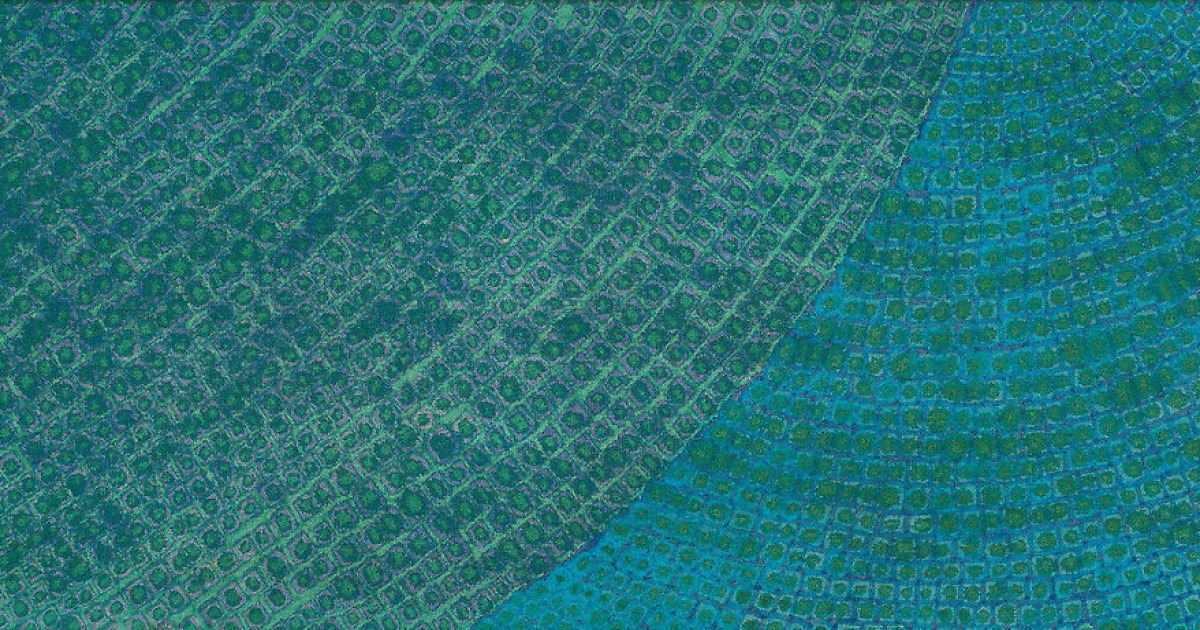

Image by Allison Saeng, Unsplash.

Image by Allison Saeng, Unsplash.This is also bringing about changes in the art market. Traditionally, due to the high trading value of artworks, the art market has been dominated by wealthy individuals with large assets. Yet, the emergence of shared art ownership or fractional investing now enables collective investments in pricier artworks. Such assets, once out of reach for the average individual, are now segmented and shared among multiple investors. This concept of fractional ownership is facilitated through platforms, which gather investors and issue the corresponding securities.

The art investment market has undergone significant evolution in recent years, primarily due to the adoption of the fractional ownership approach, with an increasing number of individuals showing interest. The financial sector observes that this fractional investing market will become more active in the future.

Until now, there were only a limited number of art investment strategies that could issue and distribute securities. In particular, due to the rapidly increasing demand for investments in sculptural art, many platforms were created, yet these platforms lacked legal protection for buyers.

However, with the entrance of investment contract securities into the regulatory framework, the value of fractional art investment businesses has risen. Investors in art fractional ownership can now operate within the framework of financial regulations, creating a safer and more active trading environment that is projected to further expand the market.

Korean securities companies are striving to lead the tokenized securities market by developing a variety of tangible and intangible asset products, including art, real estate, beef, racehorses, music, and YouTube channel revenue. Among them, the integration of virtual assets in art investment is evolving to cater to the interests of art enthusiasts, investors, and a broader potential audience. These changes are expected to foster a market with a different nature from the traditional art market.

The art market is also hustling to keep pace with these transformations.

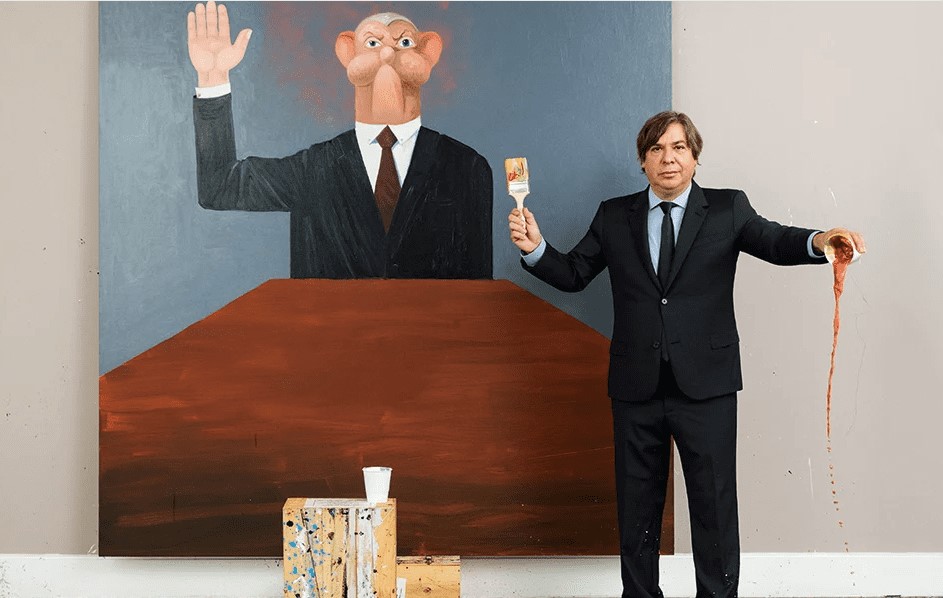

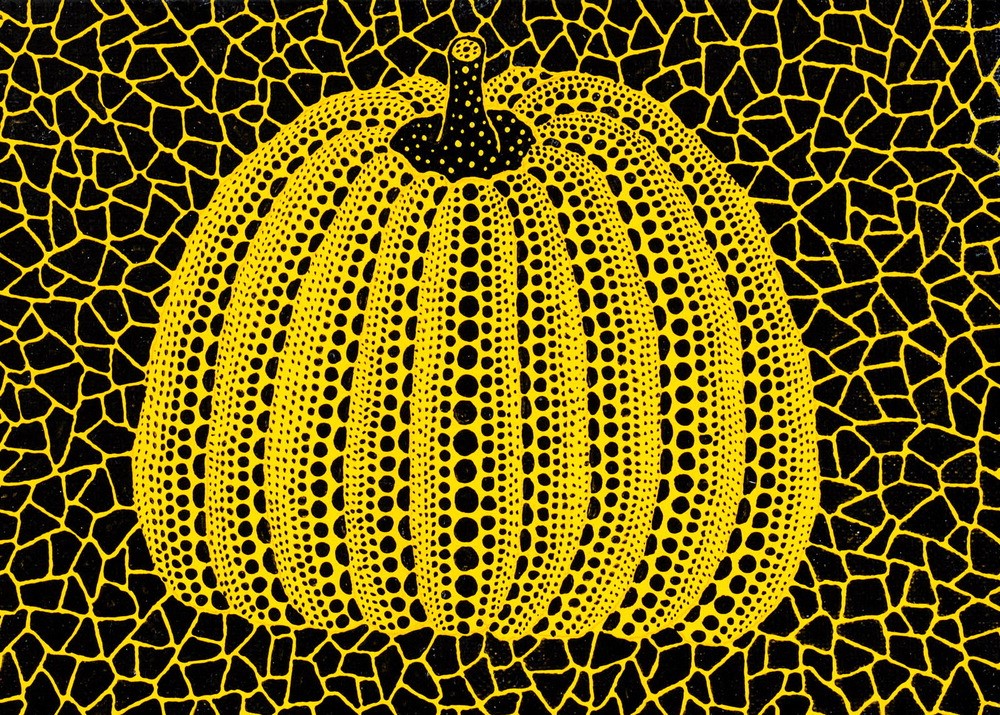

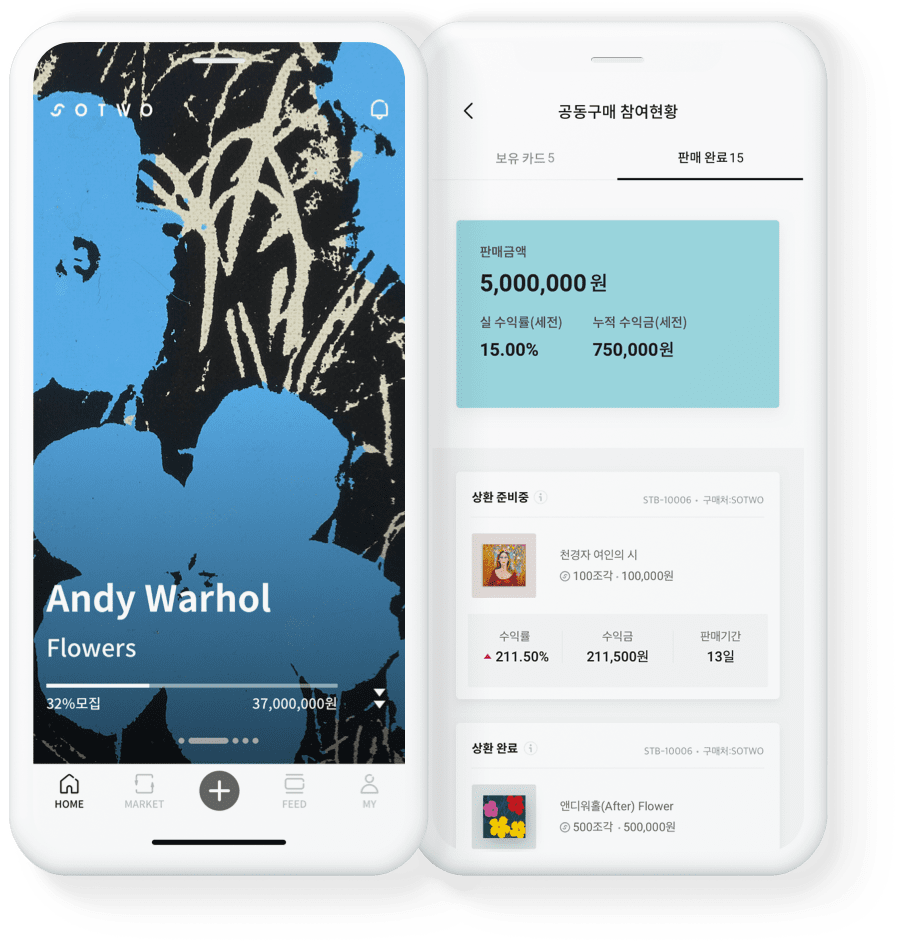

© SOTWO.

Due to the stagnation of the art market from the second quarter of 2022 to the first quarter of this year, major art auction companies such as K Auction and Seoul Auction, which compete for the top positions in the art auction market, have shown signs of retreat.

According to a report from the Korea Art Authentication & Appraisal Research Center, the sales of auction houses such as Seoul Auction, K Auction, and MyArtAuction in the first half of 2023 decreased by 47% compared to the same period last year. Particularly, Seoul Auction experienced a greater decline in sales, operating profit, and net profit compared to K Auction in March.

However, Seoul Auction experienced a revival in the third quarter, reporting a 73.4% surge in revenue from art sales, amounting to 30.4 billion KRW year-over-year, despite lower revenue from art auctions. A closer look at Seoul Auction’s recent activities sheds light on the reasons behind this increase in revenue.

Seoul Auction’s subsidiary, Seoul Auction Blue, has been actively promoting its fractional investing platform, “SOTWO,” launched in 2020. They are striving to establish a convenient and secure environment for art co-investors by collaborating with various securities firms.

As part of these efforts, Seoul Auction has appointed Lee Jung-bong, an IT specialist, as the Vice President of Seoul Auction Blue. Their focus is on strengthening businesses that combine the art market and IT, including online auctions, fractional art investments, security token offerings (STO), and non-fungible tokens (NFT) rooted in digital virtual assets. This indicates that Seoul Auction is aiming to enhance its presence in this direction.

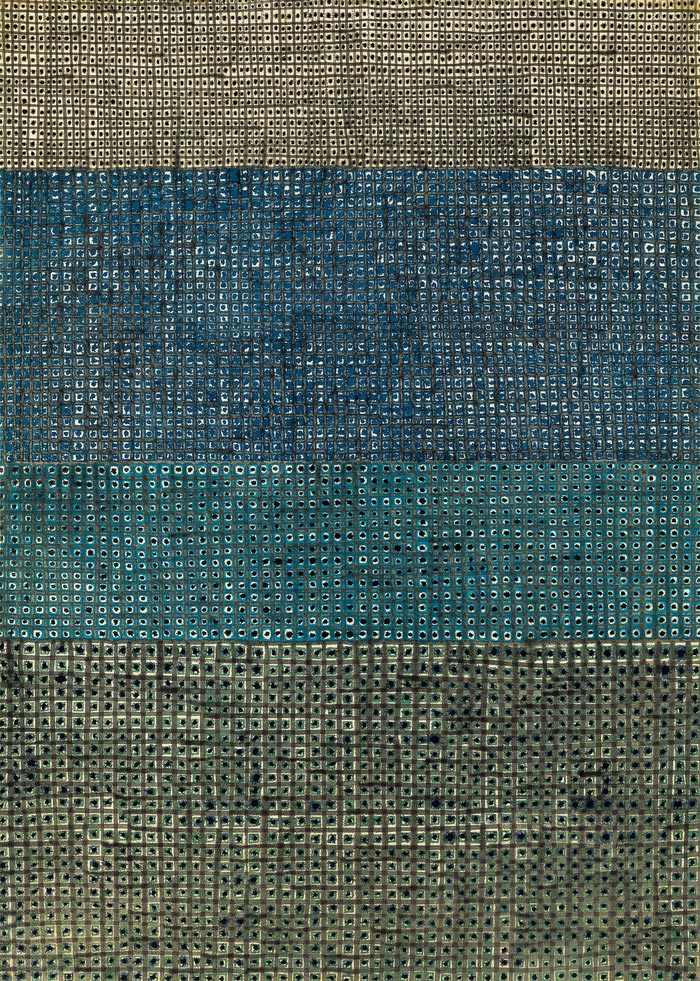

© Art Together.

© Art Together.K Auction is also swiftly adapting to the changes in the art market. Its subsidiary, Art Together, which operates fractional art investments, has become the first in Korea to submit a securities registration statement for art investment contract securities to the Financial Supervisory Service. Subscriptions are anticipated to open for investors as early as October.

Art Together, under its parent company K Auction, acquired the work Stay Song 61 by American artist Stanley Whitney for 720 million KRW and plans to issue investment contract securities based on this asset. Through this offering, they aim to raise 790 million KRW.

However, the Korea Art Authentication & Appraisal Research Center underscored the significance of these industry changes, stating that “establishing the foundation for diversified art investment methods must be interconnected with the solid foundation of the existing art distribution market, and it should work closely with the existing market.”

The center added that for the art market to achieve long-term and constructive development, it needs to adopt a proactive attitude. As investment methodologies diversify, there’s an increasing need for continuous innovation in the art sector. While adapting to current challenges and navigating evolving dynamics is crucial, the art market should also deliberate on its future course for holistic development.