The Korean art auction market experienced a sharp decline in the first quarter of 2023. From January to March, the total sales amount at Seoul Auction and K Auction, Korea’s two largest auction houses, decreased by 58% compared to 2022.

Cover image of 'Art Market Report, 1st Quarter, 2023' by Korea Art Authentication Appraisal Inc.

Cover image of 'Art Market Report, 1st Quarter, 2023' by Korea Art Authentication Appraisal Inc.The Korean art auction market experienced a sharp decline in the first quarter of 2023. From January to March, the total sales amount at Seoul Auction and K Auction, Korea’s two largest auction houses, decreased by 58% compared to 2022.

The Korea Art Authentication & Appraisal Inc. (KAAAI) published the Art Market Report for the 1st Quarter of 2023 on April 20 and predicted that the Korean art market would be bleak. While most art fields performed poorly in the first quarter of this year, the antique sector was the only one that fared slightly better in the Korean art market.

The center claimed that the Korean art market has been excessively saturated in recent years. The afterglow of the country’s art market boom still remains. However, the global economic slowdown makes it difficult to view the future of the local art market with optimism.

The Current Situation of the Korean Art Auction Market

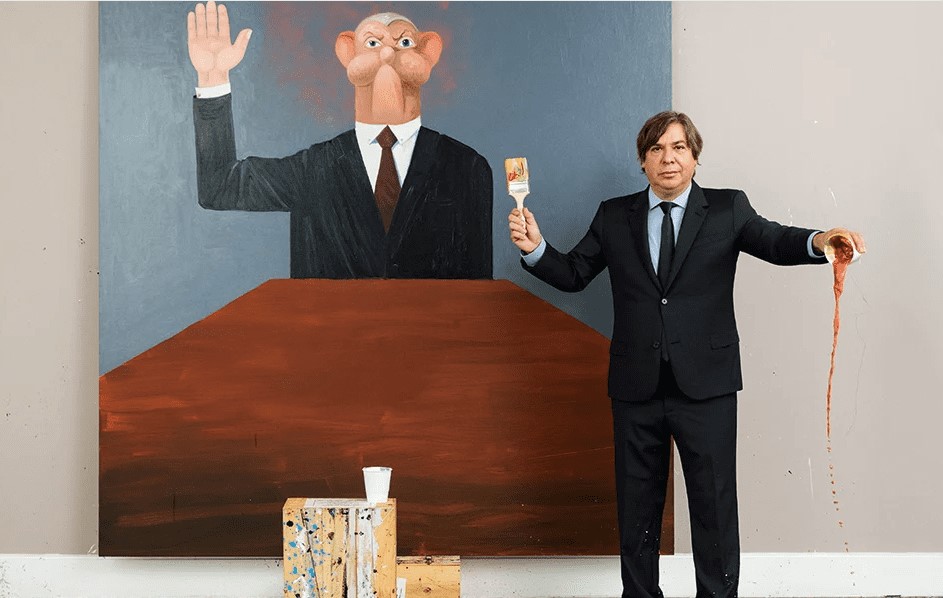

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf SEOUL 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.Seoul Auction and K Auction, the two major auction houses that account for about 80 to 90% of the Korean art auction market, held five major auctions in the first quarter of 2023, raising a total of about 25.3 billion KRW (approximately $19 million). As mentioned above, this is a decrease of about 58% compared to the same period in 2022. The total number of artworks sold was 513, a decrease of 52.4% from 782 in the same period last year.

The average bid rate was approximately 67.3%, down 15% from 2022 (approximately 82.6%). This was even lower compared to 2021 when the economic situation was even more bleak and uncertain. In the first quarter of 2023 in Korea, there were a total of 69 auctions, including nine major and 60 online auctions, with an average successful bid rate of less than 50%.

Meanwhile, Korean antique art, such as Korean paintings, ceramics, calligraphy, and wooden furniture, showed growth potential in the local art market. During the first quarter, 69.8% of the artworks sold at nine major auctions held by five auction houses were antiques and Korean paintings.

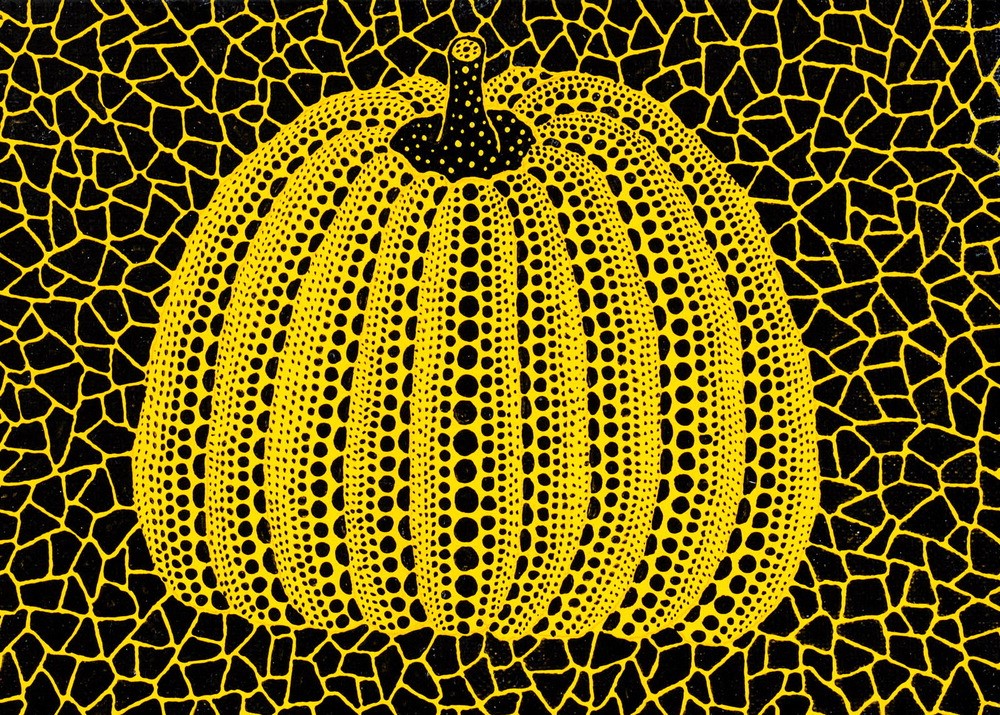

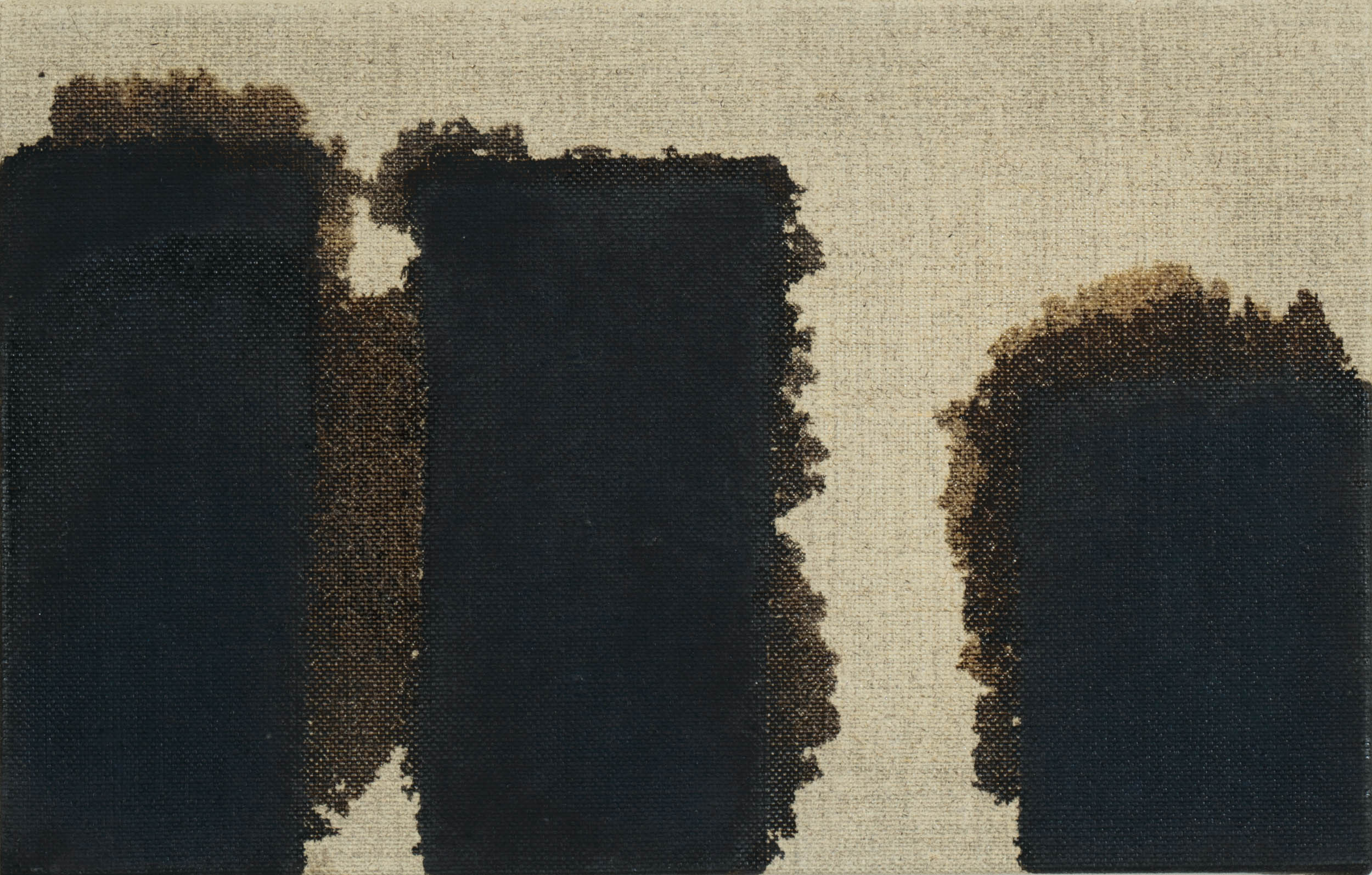

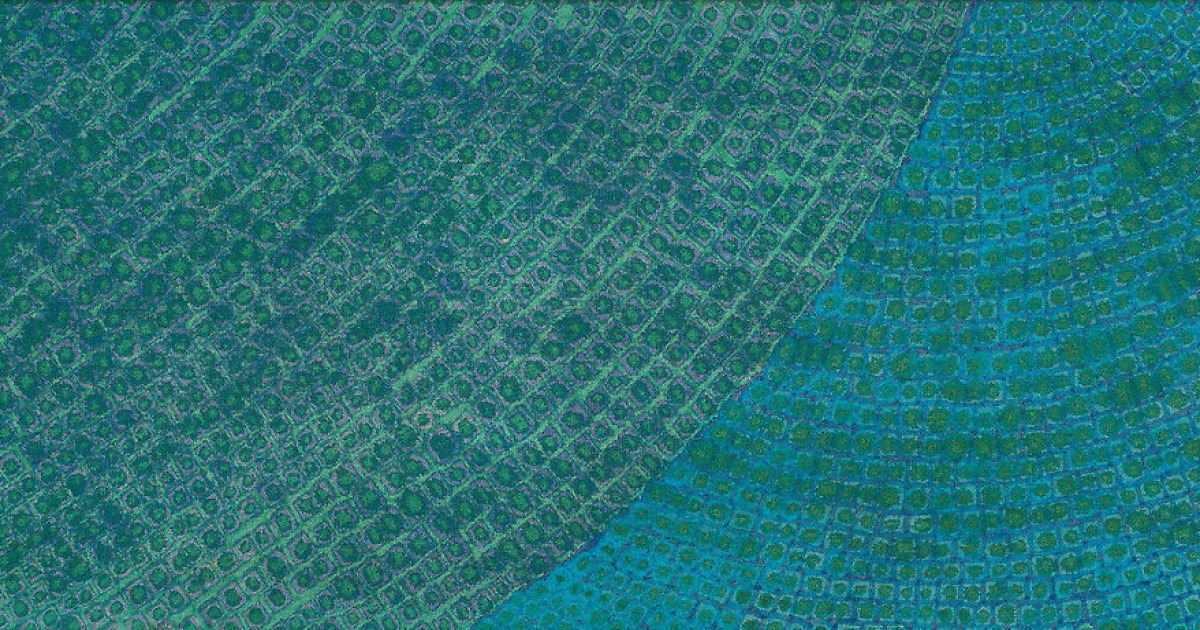

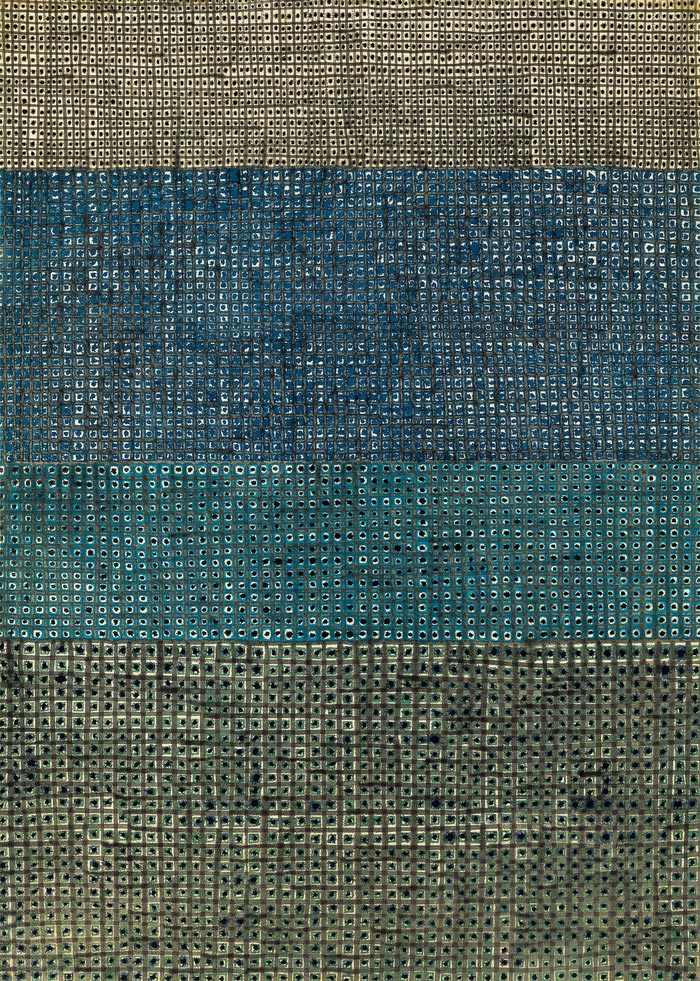

In the field of modern and contemporary art, Lee Ufan (b. 1936) took first place in the total sales amount with approximately 3.2 billion KRW ($2.4 million). Second through fifth places were occupied by Yayoi Kusama (b. 1929), Park Seo-Bo (b. 1931), Kim Whanki (1913–1974), and Yoo Youngkuk (1916–2002).

Yoo Youngkuk and Lee Bul were the two artists in the modern and contemporary art sector that made some progress in the market in the first quarter of this year.

The total sales amount of Yoo Youngkuk’s works rose sharply to fifth place this year from eighth place in 2022, making him the most notable artist in the modern and contemporary art sector. At Seoul Auction’s Hong Kong sales, Work (1964) by the artist was sold for a high price of 1.07 billion KRW. Yoo Youngkuk had a retrospective solo exhibition at Kukje Gallery last year and is currently represented by Pace gallery.

Lee Bul (b. 1964), represented by the BB&M Gallery in Seoul, stood out among contemporary artists. At a major auction held at K Auction on March 29, 2023, the artist’s Alibi (1994) was sold for 34.95 million KRW, more than ten times the low-price estimate. The center added that Lee Bul is having a solo exhibition at Thaddaeus Ropac London.

International Art Auction Market

Paris+ par Art Basel 2022. Courtesy of Art Basel.

Paris+ par Art Basel 2022. Courtesy of Art Basel.The situation of the global art market is not significantly different from that of the Korean art market. The center utilizes Art Basel and UBS’s Art Market Report and ArtTactic’s RawFacts AUCTION REVIEW 1st Quarter 2023 report to provide a more comprehensive view of the Korean art market.

The global art market saw a 3% increase in total sales in 2022 and a 1% increase in volume. It showed a solid sales record only at the high end of the market. In the primary market, top artists accounted for 30% of the total sales and also demonstrated a strong sales record in the auction market.

Christie’s, Sotheby’s, and Phillips, the world’s three largest auction houses, reported a 13.6% decline in sales in the first quarter of this year compared to the previous year. Auction sales closed at approximately $1.32 billion, a decrease from approximately $1.52 billion in the first quarter of 2022.

The center mentioned that post-war and contemporary art recorded the largest market shares in the global art market. The sales of post-war and contemporary art accounted for approximately 33.3% of total sales for the quarter, an increase of approximately $439 million, the same amount year-on-year.

However, the fall in the ultra-contemporary art (works created by artists under the age of 40) sector was significant. In 2022, Asian buyers demonstrated the most purchasing power in the ultra-contemporary art sector. Yet, the center pointed out that Asian buyers who belatedly joined the ultra-contemporary art market, which had reached its peak, are enduring the price shock.

Impressionism and the modern art sector recorded the second largest volume, with sales of approximately $307.2 million in the first quarter of 2023. The sector accounted for approximately 23.3% of the art auction market’s total sales, which is 13.2% less than its 36.5% share in the same quarter of the previous year. On the other hand, Old Masters (artworks created before 1800) auctions accounted for about 13.1% of total sales, roughly twice as much as last year.

Global Economic Situation

Paris+ par Art Basel 2022. Courtesy of Paris+ par Art Basel.

Paris+ par Art Basel 2022. Courtesy of Paris+ par Art Basel.The center also referred to the global economic situation, which will have a substantial impact on the Korean art market.

With rising interest rates, 2023 marked the collapse of Silicon Valley Bank (SVB) and the tumbling shares of Germany’s Deutsche Bank, dragging down other major American and European banks. This has led to a decline in the South Korean construction property market.

After increasing rates in March 2022, the US Federal Reserve has increased the federal funds rate to a target range of 4.75%–5% to mediate out-of-control inflation. The increase in the policy rate leads to a decline in bond, stock, and real estate prices.

This, undoubtedly, is also affecting the art market. The art market, just like any other industry, can be active when funds can be easily financed at low-interest rates. The center recognizes that such an era has come to an end.

How Should the Korean Art Market Deal with a Weak Economic Outlook?

Kiaf PLUS 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.

Kiaf PLUS 2022. Photo by Kiaf Operating Committee. Courtesy of Kiaf.The center stresses that this global recession should be viewed as an opportunity for a new leap forward.

The standards for art are continuously rising in Korea, with leading international galleries introducing various prominent artists in the country, the opening of Frieze Seoul, and the Centre Pompidou’s plans to open a branch in Korea in 2025.

Within this situation, the center emphasized that, no matter how long it takes, it is now inevitable for the Korean art market to improve its art market system and infrastructure to achieve higher cultural standards.

According to the center, a solid foundation for the art market can be built by establishing a system capable of delivering accurate information about the market and providing access to price databases. Thus, a proper infrastructure entails building a system that can deliver accurate information and create conditions where many people can easily access it.

There is much work to be done to address this issue in the Korean art market. On their websites, auction houses only display successful bids while concealing the results of failed bids to cover the poor performance. Galleries report sales generated by participating in art fairs separately from gallery sales, thereby misleading the size of the entire art market in Korea.

The center emphasized that art market members should act responsibly and provide accurate data, as this is a crucial indicator for properly diagnosing the size of the art market and drawing a blueprint for the future. It pointed out that it will only be possible to accurately judge the unstable art market and steer it in the right direction if these shortcomings are addressed.